- P&G is expected to report a 2% revenue growth in the quarter, after two quarters of decline.

- Adjusted EPS is expected to decline.

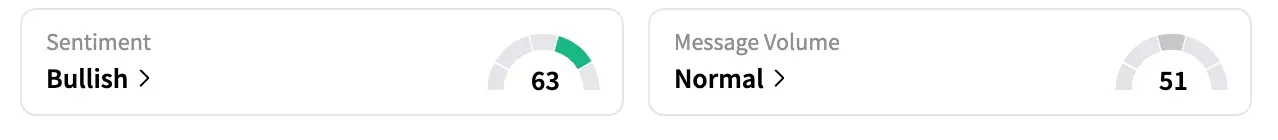

- Shares and retail sentiment have climbed higher ahead of the report in pre-market hours.

Retail sentiment for Procter & Gamble Co. shifted to ‘bullish’ as of early Friday, from ‘bearish’ the previous day, ahead of the consumer packaged goods giant’s quarterly results before the market opens. PG shares rose 0.6% in early premarket trading.

The optimism is partially supported by European peer Unilever’s upbeat earnings on Thursday. Analysts expect P&G’s fiscal first-quarter sales to rise 2% to $22.17 billion, compared to declines in the preceding two quarters, according to Koyfin data.

Adjusted EPS is expected to drop to $1.90 from $1.93 a year. Any changes to P&G’s fiscal 2026 guidance or comments regarding future demand would likely drive the stock. The company had previously guided core earnings per share growth of flat to 4%, driven by 0% to 4% organic sales growth and a 1% to 5% rise in net sales for the ongoing fiscal.

RBC Capital Markets, which has an ‘Outperform’ rating on the company’s shares, expects P&G to reiterate those targets. Shares of the company are on a weak run this year, but rebounded in the past week.

“$PG Entering long,” a bullish user posted on Thursday.

https://stocktwits.com/Reanimated666/message/633415294

Currently, 14 of the 24 analysts rate the stock ‘Buy’ or higher, nine rate it ‘Hold,’ and one rates it ‘Strong Sell,’ according to Koyfin. As of the last close, the stock has declined 9.2% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<