Under this arrangement, investors will immediately be able to convert the existing warrants, allowing the purchase of about 185 million shares at $2.00 each, into a mix of common stock and pre-funded warrants.

Plug Power Inc.(PLUG) disclosed on Wednesday that it has struck a warrant inducement deal with a single institutional investor that will lead to the full exercise of all its March 2025 warrants.

Under this arrangement, investors will be able to immediately convert the existing warrants, allowing the purchase of about 185 million shares at $2.00 each, into a mix of common stock and pre-funded warrants.

In exchange, Plug Power will issue new warrants exercisable at $7.75, about 100% above its closing price on October 7. The move is expected to generate approximately $370 million before fees and costs.

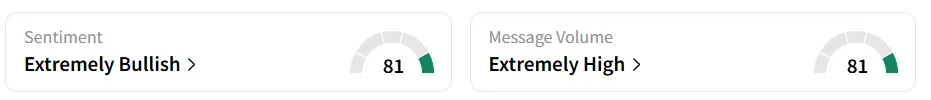

Plug Power stock traded over 7% lower on Wednesday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

The stock saw a 1,944% surge in user message count over the past month after a slew of project updates, according to platform data. A bullish Stocktwits predicted the stock price could nearly double from its current levels by the end of the year.

Another user predicted that the stock would reach $10 by the end of the month.

If all the new warrants are exercised for cash, Plug Power stands to raise as much as $1.4 billion more. The development comes a day after insider Jose Luis Crespo was appointed as the new Chief Executive Officer, succeeding long-time head Andy Marsh.

The company has been under retail investors’ spotlight due to optimism around the efficiency of its hydrogen projects. Plug Power stock has gained over 66% year-to-date and 72% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<