Peloton also beat expectations for revenue and profit for the last quarter.

- The connected workout company forecasted $665 million and $685 million for its fiscal second quarter, exceeding analysts’ targets.

- Peloton also beat expectations for revenue and profit for the first quarter.

- Management admitted that the demand for connected fitness in the U.S. continues to soften.

Peloton Interactive Inc.’s shares jumped 7.8% in early premarket trading on Friday, after the company shared a stronger-than-anticipated holiday quarter forecast following its strong results.

Financial Performance

Amid efforts to reposition itself as a holistic wellness company, Peloton forecast revenue between $665 million and $685 million in the December quarter, beating Wall Street’s expectations of $661 million.

In its fiscal first quarter that ended in September, Peloton’s total revenue declined 6% to $551 million, but beat the $542.8 million target. EPS was $0.03, a cent higher than expectations.

“Our continued momentum on bottom line performance sets the stage for improvements on the top line as we progress through the fiscal year, fueled by our commitment to innovation and growing the Peloton community,” Chief Executive Officer Peter Stern said in a statement.

During the quarter, the total number of members on the Peloton platform declined 6% year-over-year to 5.9 million, and paid app subscribers decreased 8% year-over-year to 542,000.

Improving Outlook

The connected fitness market in the U.S. continues to decline after a pandemic-era surge, but at a slower rate, Peloton management said on the analyst call.

“We’re pretty encouraged by the trajectory it is moving toward… We do see that consumers are placing just a higher value on fitness and wellness,” they said.

Last month, Peloton, under new management, unveiled a major product redesign, including updated versions of Bike, Bike+, Tread, and Tread+. The company also introduced a new Row+ model and Peloton IQ, an artificial intelligence platform for personalized coaching.

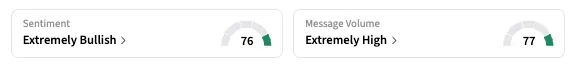

On Stocktwits, the retail sentiment for PTON shifted to ‘extremely bullish’ as of early Friday, from ‘neutral’ the previous day.

Major Recall

Separately, Peloton Interactive is recalling about 833,000 units of its Original Series Bike+ after receiving three reports of seat posts breaking and detaching during use, including two cases that resulted in injuries from falls, the U.S. Consumer Product Safety Commission said Thursday.

The recall covers units with model number PL02 in the U.S. and Canada sold from January 2020 through April 2025, the agency said.

In 2023, the company had to recall approximately 2 million of its bikes due to a similar issue with the seat post.

As of the last close, PTON shares had declined about 23% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<