Reuters reported that some investors feel the offer price is high, especially given the recent weakness in the restaurant sector.

- Apollo had reportedly submitted a $64-a-share acquisition offer for Papa John’s last month.

- Reuters reported that some investors feel the offer price is high, especially given the recent weakness in the restaurant sector.

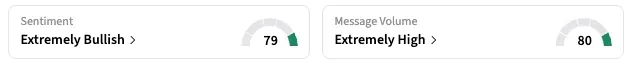

- Stocktwits sentiment for PZZA shifted to ‘extremely bullish’ from ‘bearish.’

Papa John’s International, Inc.’s shares dropped 10% on Tuesday, even as retail sentiment ticked higher, after a media report stated talks for a buyout of the pizza chain had hit a roadblock.

Reuters, citing people familiar with the matter, reported on Tuesday that Apollo Global Management pulled its $2.1 billion bid for the company last week. It is unclear why the private equity firm withdrew its offer, although recent earnings reports from Chipotle Mexican Grill and Cava Group indicate continued weakness in the restaurant industry.

PE Interest In Restaurants

Apollo and Irth Capital Management submitted a joint offer for the company at just above $60 per share earlier this year, before Apollo submitted a solo bid in early October, according to earlier Reuters reports.

While some PE investors are still interested in acquiring the pizza chain, they do not believe it is worth $64 a share, given the softening consumer demand for fast-casual food, according to Tuesday’s report.

To be sure, private equity interest in the sector is gaining momentum. Earlier this week, diner chain Denny’s Corp. was acquired for $620 million by a consortium led by TriArtisan Capital and Treville Capital, following recent buyouts of brands such as Subway and Dave’s Hot Chicken.

Papa John’s plans to release its third-quarter results on Thursday. Analysts expect revenue to increase 3.5% to $524.7 million and adjusted EPS to decline 5.4% to $0.41, according to Koyfin.

What Is Retail Investors’ View?

On Stocktwits, the retail sentiment for PZZA shifted to ‘extremely bullish’ as of late Tuesday, from ‘bearish’ the previous day, with 24-hour message volume rising a whopping 8,000%.

Some retail investors kept their confidence in an eventual deal. “$PZZA something is iffy about this whole thing. Rumor of withdrawn offer after they opened the books,” questioned one user. “I’m thinking this is a power move to force the boards hand.”

As of the last close, PZZA stock has gained 5.8% year-to-date. The company had a market cap of $1.42 billion as of Tuesday

For updates and corrections, email newsroom[at]stocktwits[dot]com.<