Short interest in the stock, though having risen from June lows, is still low compared to its historical highs around 7.75% in October 2023, according to Koyfin.

Palantir Technologies (PLTR) stock appears on track to fall for a second straight session as it traded over 1% lower in the early premarket session on Tuesday.

After snapping a six-session losing streak last Thursday with a marginal climb, the Alex Karp-led company’s stock rallied sharply on Friday as Federal Reserve Chair Jerome Powell rekindled rate cut hopes.

As the broader market pulled back on Monday, following the fading of rate cut euphoria, Palantir’s stock also declined. It settled down about 1% at $157.17.

The recent lean patch in the stock came after Citron’s Andrew Left disclosed that he had shorted the stock. Comparing with private artificial intelligence (AI) startups OpenAI and Databricks, Citron said in a short report that Palantir’s stock is overvalued by about 75%.

CNBC Mad Money host Jim Cramer, however, has thrown his weight behind the AI-powered data analytics company. After blaming shorts for the current predicament, he warned in a post on X on Monday not to “overplay their hand.”

“Karp knows all,” he said.

Short interest in the stock, though having risen from June lows, is still low compared to its historical highs around 7.75% in October 2023, according to Koyfin.

Cramer followed up on his defense of Palantir. “I heard so many people over obits for Palantir that I am now waiting for the empire to strike back,” he said.

Potential order news flow and broader market catalysts, such as a Fed funds rate cut, could serve as immediate upside triggers, given its next quarterly results are months away.

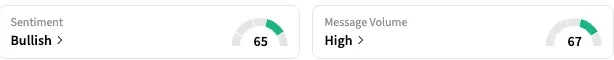

On Stocktwits, retail sentiment toward Palantir stock remained ‘bullish’ (65/100), and the message volume also stayed at ‘high’ levels.

Notwithstanding the recent weakness, Palantir stock is still up over 107% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<