Piper Sandler highlighted that Palantir’s commercial segment has delivered triple-digit booking growth so far this year, a key signal that demand remains strong.

Piper Sandler has lifted its price forecast for Palantir Technologies Inc. (PLTR), increasing its target to $201 from the previous $182. The firm reaffirmed its ‘Overweight’ rating, maintaining a bullish stance on the data analytics company despite valuation concerns.

While acknowledging the stock’s premium pricing, the firm argues that Palantir’s robust visibility into future revenue, coupled with surging momentum in commercial bookings, supports continued upside potential.

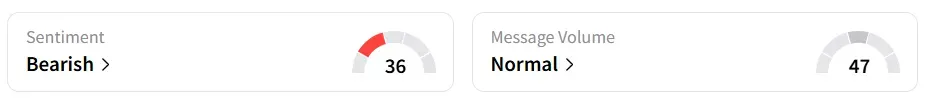

Palantir Technologies’ stock traded over 1% higher on Tuesday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘normal’ message volume levels.

The stock experienced a 135% increase in user message count in 24 hours. A Stocktwits user said they have added to their stock position.

Piper Sandler highlighted that Palantir’s commercial segment has delivered triple-digit booking growth so far this year, a key signal that demand remains strong. Despite the high expectations baked into the stock’s price, the firm believes this growth trajectory is far from peaking.

Another driver, according to Piper, is Palantir’s significant role in the U.S. defense ecosystem. With access to a share of the nation’s $1 trillion defense budget, the company is uniquely positioned to continue scaling operations and deepening its government relationships. This positioning, the firm suggests, provides an unparalleled wallet share opportunity.

The company is scheduled to release its third-quarter (Q3) earnings on November 3. The data platform provider anticipates a Q3 revenue between $1.083 billion and $1.087 billion compared to the analysts’ consensus estimate of $1.09 billion, according to Fiscal AI data.

Palantir stock has gained over 136% in 2025 and over 311% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<