Comparing OpenAI and Palantir, Citron’s report stated that OpenAI’s revenue growth is rapid and unprecedented, while Palantir has seen only a steady pace of increase.

Palantir stock was the top trending ticker on the Stocktwits platform late Tuesday, even as the stock dropped for a fifth straight session.

The losing streak comes amid short seller Citron Research, run by Andrew Left, renewing its attack on the Alex Karp-led artificial intelligence (AI)-powered data analytics company. Notwithstanding the recent losses, Palantir stock is the best-performing among the S&P 500 companies so far this year.

Left, while making his appearance on Fox News last Wednesday, said he was short on Palantir, citing the company’s excessive valuation. At that time, the short-seller said a more rational valuation for the stock could be $65 or $70.

On Sunday, Citron put out a comprehensive short report on Palantir, stating that if Sam Altman-led AI startup OpenAI were to be valued at $500 billion, Palantir’s per-share value, even while valued generously, should be only at $40.

Comparing OpenAI and Palantir, the report stated that OpenAI’s revenue growth is rapid and unprecedented, while Palantir has seen only a steady pace of increase.

While OpenAI’s total addressable market (TAM) is measured in trillions of dollars, across every consumer, enterprise, and developer use case, Palantir has privy to only defense and enterprise contracts that scale slowly and compete head-on with giants like Microsoft and Databricks.

“OpenAI is creating a flywheel that Palantir lacks. Each new user enhances the models, improves the product, and widens the moat—fueling a cycle of growth, data, and scale reminiscent of Google in its prime, not a defense contractor,” Citron said.

“Palantir’s stickiness is real, but its growth hinges on slow, customized contracts that don’t compound.”

Citron also expressed uneasiness over insider stock sales at Palantir, stating that “Karp is proving he’s cashing out, using Palantir’s AI rally as his personal exit strategy.”

As such, the firm stated that Palantir’s stock appears overvalued relative to its fundamentals. The current forward price-earnings (P/E) multiple for the stock is over 210 times.

Chart courtesy of Koyfin<

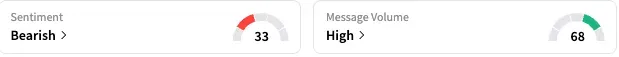

On Stocktwits, sentiment toward Palantir stock stayed ‘bearish’ (31/100) by late Tuesday, but the message volume picked up to ‘high’ levels amid the short report.

A bearish investor called Palantir a “scam no less.”

Another user shared Left’s sentiment, calling Palantir the “most valued firm of all time.”

Palantir stock has gained about 109% this year. Technically, the stock’s relative-strength index (RSI) dropped just below the neutral zone and it has back-filled a gap from early August. The stock is fast approaching a support at its 50-day simple moving average (SMA), currently at $152.18.

Chart courtesy of Koyfin<

The Koyfin-compiled average analysts’ price target for Palantir stock is $151.31, suggesting roughly 4% downside from current levels, far less than what Citron is modeling.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<