According to a Bloomberg report, the bond issuance, projected to total roughly $20 billion to $25 billion, will cover about half of Oracle’s 2026 financing needs.

- Oracle plans to issue the bonds in a single tranche, and the offering may be divided into up to eight parts.

- Bond maturities shall range from three to 40 years.

- On Sunday, the company announced its plan to raise $45 billion to $50 billion in total funding through a combination of debt and equity instruments.

Oracle Corp. (ORCL) has reportedly launched a major U.S. dollar bond offering, expected to be in the range of $20 billion to $25 billion.

Earlier, the company announced it was looking to raise between $45 billion and $50 billion through a mix of debt and equity sales to ramp up its cloud business. infrastructure capabilities.

Debt Structure

According to a Bloomberg report, the bond issuance, projected to total roughly $20 billion to $25 billion, will cover about half of Oracle’s 2026 financing needs. The remaining planned funding will come from equity-linked and common stock sales, signaling a multi-pronged strategy to support growth initiatives.

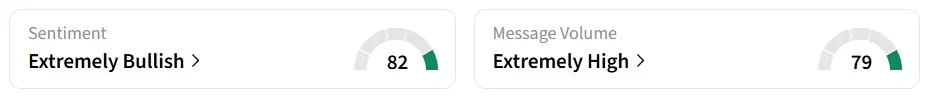

Oracle stock traded over 3% higher on Monday morning. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory while message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock saw 641% increase in retail chatter over 24 hours as of Monday morning. The bond’s maturities range from three to 40 years, the report stated.

Strategic Rationale

The move reflects Oracle’s effort to finance the expansion of AI-driven cloud services for major clients. The company previously raised $18 billion in September 2025, after cementing a $300 billion contract with OpenAI.

On Sunday, the company announced its plan to raise $45 billion to $50 billion in total funding through a combination of debt and equity instruments.

“Oracle is raising money in order to build additional capacity to meet the contracted demand from our largest Oracle Cloud Infrastructure customers, including AMD, Meta, NVIDIA, OpenAI, TikTok, xAI and others,” the company stated.

Oracle’s approach comes amid an increasingly competitive cloud landscape, with rivals such as Microsoft (MSFT) and Amazon.com (AMZN) also investing heavily in infrastructure.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<