Analyst Alex Haissl noted that Oracle’s projections for cloud revenue over the next five years indicate a total valuation of approximately $60 billion, implying that investors are factoring in a highly optimistic growth scenario.

Rothschild & Co Redburn has launched coverage on Oracle Corp. (ORCL) with a ‘Sell’ rating alongside a $175 price target, with the analyst citing concerns that the tech giant’s cloud revenue potential is being misjudged by investors, as per TheFly.

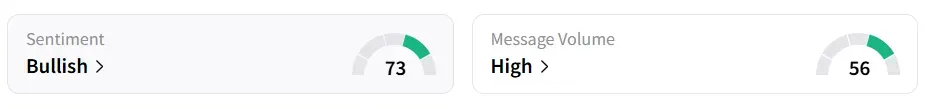

Oracle stock traded over 3% lower in Thursday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

The stock experienced a significant 2,261% increase in user message count over the past month. A bullish Stocktwits user said the price drop is a ‘once in a lifetime opportunity’.

Analyst Alex Haissl argues that the market “materially overestimates” the worth of Oracle’s cloud contracts, particularly in single-tenant setups where Oracle acts more like a lender than a traditional cloud vendor, “with economics far removed from the model investors prize”.

Haissl pointed out that Oracle’s projections for cloud revenue over the next five years suggest a total valuation of approximately $60 billion. In his view, this implies investors are factoring in a highly optimistic growth scenario, one that may not play out as expected.

On September 10, outgoing CEO Safra Catz said the company had signed four multi-billion-dollar contracts in the first quarter and expects to book cloud orders exceeding half a trillion dollars.

The tech giant expects second-quarter (Q2) revenue growth of 14% to 16%, and cloud revenue growth of 33% to 37%. It anticipates Q2 earnings per share (EPS) in the $1.61 to $1.65 range, compared to analyst expectations of $1.48, according to Fiscal AI data.

Oracle stock has gained over 85% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<