The stock faces turbulence partly due to uncertainty around a warrants issue.

- Noted hedge fund D.E. Shaw disclosed on Thursday that it had acquired over 60 million shares of Opendoor.

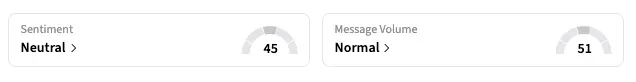

- Stocktwits sentiment for OPEN continued in the ‘neutral’ zone.

- The stock has declined for six straight sessions, partly due to uncertainty around a warrants issue.

Opendoor Technologies, Inc. drew fresh retail buzz on Friday after the disclosure of a sizable minority ownership by D.E. Shaw.

The influential hedge fund, known for its quantitative trading, has acquired a 6.4% stake in Opendoor, according to its 13G filing on Thursday. D.E. Shaw bought 60.7 million shares on Nov. 13.

The development comes at a turbulent moment for Opendoor — the “meme stock” has fallen for six consecutive sessions, shedding 35% in total, as the company pushes through a warrants issue and figures like investor Eric Jackson and CEO Kaz Nejatian issue bold growth forecasts.

EMJ Capital founder and Opendoor investor Jackson, whose bullish commentary sparked the rally in Opendoor’s shares back in July, has said the company is well executing its growth plans and expects the stock could rise as high as $500.

The management has also been more vocal lately, regularly discussing business updates and new products on X. Nejatian posted on X on Thursday about a company hackathon and internal presentations by executives from OpenAI and Cursor.

However, Stocktwits sentiment for OPEN ticked lower. The Stocktwits sentiment reading has dropped to ‘neutral’ since the start of Thursday, gradually descending from ‘extremely bullish’ a week ago.

“$OPEN never had so much anticipation for a week, and absolutely get beat down! Regroup and try again next week,” a user said, amid several comments advising investors to be patient with the stock.

“Just buy and HODL folks. Opendoor will make few percentage of the shareholders wealthy, some will become rich, and most won’t make anything because a lot of people can’t cope with market movements,” said another user.

As of the last close, the OPEN stock is down by over 40% since its peak on Sept. 11, but is still up 285% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<