Notably, the short interest in Opendoor stock has fallen from its peak of 22.8% in mid-September to 20.5% as of Monday.

Opendoor Technologies Inc. shares slipped 3% in early premarket trading Tuesday, sending the ticker to the top of Stocktwits’ trending list.

Messages from users reflected cautious optimism, with many urging to stay invested despite the recent weakness. The stock has fallen for four straight sessions, losing more than 22% in total.

“$OPEN there is a pattern of 4 red days followed by 3 green days. Looking forward to our 3 green days starting tomorrow,” said one hopeful user.

CEO “Kaz (Nejatian) will no doubt have a raft of news leading up to earnings. New appointments, partnerships and a clear plan to profitability! I’m going nowhere until $82!!! Bring it on,” said another.

That said, the premarket drop shows that investors are increasingly frustrated with the stock’s underperformance and the lack of significant catalysts to trade off.

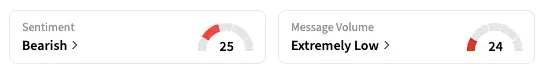

Stocktwits sentiment for OPEN was ‘bearish’ as of the last reading, with the score lower than from a week ago, and in unchanged territory since the start of October.

Opendoor will announce third-quarter results on Nov. 6. Notably, the short interest in Opendoor stock has fallen from its peak of 22.8% in mid-September to 20.5% as of Monday, according to Koyfin data.

Shares of the online real-estate company have been the subject of much enthusiasm from retail traders and commentators, driving them higher in recent months.

The rally started in early July after EMJ Capital’s Eric Jackson posted bullish commentary and an $82 price target on the stock at a time when it was below $1. From July through September, OPEN stock has risen about 1,300%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<