In the technical charts, a breakout backed by rising volumes typically confirms strength, but in Ola’s case, the low volume raises concerns about sustainability, an analyst said.

Ola Electric shares gained 5% on Thursday, hitting the upper circuit for a second consecutive session.

The cab services and electric two-wheeler maker has entered the energy storage space with the launch of its Battery Energy Storage System (BESS) space called Ola Shakti. Ola Shakti is a portable, on-demand power solution built for homes, farms, and small businesses, the company said in a press release on October 16.

Battery Energy Storage Systems help store energy from sources like solar and wind and release it when demand peaks. The technology is deemed crucial in shifting from fossil fuels to renewables.

Ola expects its BESS consumption to scale up to 5 GWh annually in the coming years as it plans to expand from residential systems to grid-scale deployments.

All systems will be powered by the indigenously developed 4680 Bharat Cell technology, produced at the company’s Ola Gigafactory. Ola Shakti is India’s first fully designed, engineered, and manufactured residential BESS, offering automotive-grade safety and 98% efficiency, according to the press release.

Ola Shakti also features smart energy management, allowing users real-time control via an intelligent interface with features like ‘Time of Day scheduling’, remote diagnostics, OTA updates, and intelligent backup prioritization.

The BESS is launched in 1.5 kWh, 3 kWh, 5.2 kWh, and 9.1 kWh battery configurations at a price of ₹29,999, ₹55,999, ₹ 1,19,999 and ₹1,59,999, respectively, for the first 10,000 units. The system can power air conditioners, refrigerators, induction cookers, farm pumps, and communication equipment.

Lack Of Volumes A Concern?

Ola’s stock is showing strength on the daily chart after the company announced the launch of Ola Shakti, marking its entry into the energy storage market. Technically, the stock is trading near a channel breakout zone, though the absence of strong volumes suggests caution, said SEBI-registered Orchid Research.

A breakout backed by rising volumes typically confirms strength, but in this case, the low volume raises concerns about sustainability, according to analysts.

The relative strength index (RSI) indicates positive momentum, and with strong news flow, traders may consider opportunities with a strict stop-loss at ₹52.8 to maintain a favorable risk-reward setup.

Ola Among The Top Trending Indian Stocks

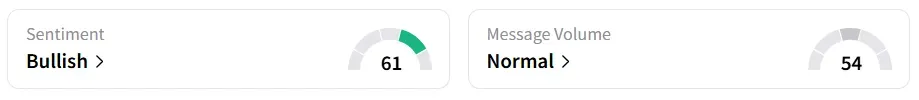

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day back. It was ‘bearish’ last week. It was the top trending stock on the platform.

Although the stock gained 10% over two sessions, it has faced significant selling pressure in 2025, resulting in a decline of over 35%.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <