The ETF has declined about 7.6% this year, according to Koyfin data, amid a decline in crude oil prices.

- Brent crude prices hovered around $62 per barrel at the time of writing, after a 4% decline in the previous session.

- The selloff came after the producer group OPEC+ said global oil markets moved into a surplus in the third quarter, contrary to its earlier forecasts of a deficit.

- “There’s a lot of oil supply that’s coming back from the OPEC+ countries that have been holding supply back.” — Mike Wirth, Chevron’s CEO.

The United States Oil Fund (USO), one of the biggest energy-focused exchange-traded funds in the world, is on course for its worst decline since the onset of the COVID-19 pandemic.

The ETF has declined about 7.6% this year, according to Koyfin data, amid a decline in crude oil prices, weighed down by economic uncertainties and oversupply concerns. Brent crude prices hovered around $62 per barrel at the time of writing, after a 4% decline in the previous session.

OPEC+ Issues Surplus Warning

The selloff came after the producer group OPEC+ said global oil markets moved into a surplus in the third quarter, contrary to its earlier forecasts of a deficit. The group, which includes Saudi Arabia and the United Arab Emirates, said in its monthly report that world oil production exceeded demand by 500,000 barrels per day during the quarter, compared with a 400,000-barrel-per-day shortfall projected earlier.

The group also estimates that supplies outside OPEC and its allies rose by 890,000 bpd in the period, with the U.S. accounting for much of the growth. The outlook comes after OPEC+ said it would pause rapid production hikes for the first three months of the year due to seasonality.

Chevron CEO Is Alarmed

Mike Wirth, the top boss of oil major Chevron, warned that oil prices will feel more pressure in 2026 than liquefied natural gas prices due to OPEC+ oversupply.

“Oil prices in 2026 are likely to feel more pressure than LNG prices,” Wirth said to Bloomberg Television. “There’s a lot of oil supply that’s coming back from the OPEC+ countries that have been holding supply back.”

Earlier, the producer group also trimmed its 2026 demand forecast for OPEC+ crude by 100,000 bpd from prior forecasts, after raising its non-OPEC+ supply estimates. Its 2026 production outlook suggests oil markets will post a surplus, a worrying sign for major oil and gas companies whose depleting cash flows have raised concerns about their ability to return cash to shareholders.

What Are Stocktwits Users Thinking?

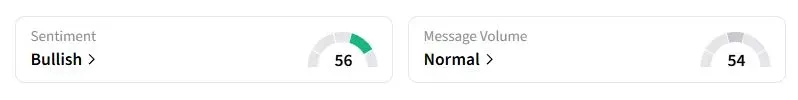

Retail sentiment on Stocktwits about the United States Oil Fund was still in the ‘bullish’ territory at the time of writing, compared to ‘bearish’ a day ago.

IEA’s Reintroduced Scenario Shows Oil Demand Growing

Earlier on Wednesday, the International Energy Agency reintroduced a scenario in its forecast, projecting that oil demand will continue to rise until 2050, marking an extraordinary shift in tone toward fossil fuels.

The Paris-based IEA reintroduced the “Current Policies Scenario,” or CPS, under which oil consumption grows by 13% by 2050, aided by weak adoption of electric vehicles without policy support.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<