Analysts at UBS, Melius Research, DA Davidson, and Bank of America raised price targets, citing strong AI demand and partnerships.

Nvidia (NVDA) rose as much as 5% in pre-market trade on Wednesday, edging closer to becoming the first U.S. company to reach a $5 trillion market capitalization, after announcing $500 billion in AI chip orders and plans to build seven supercomputers for the U.S. government.

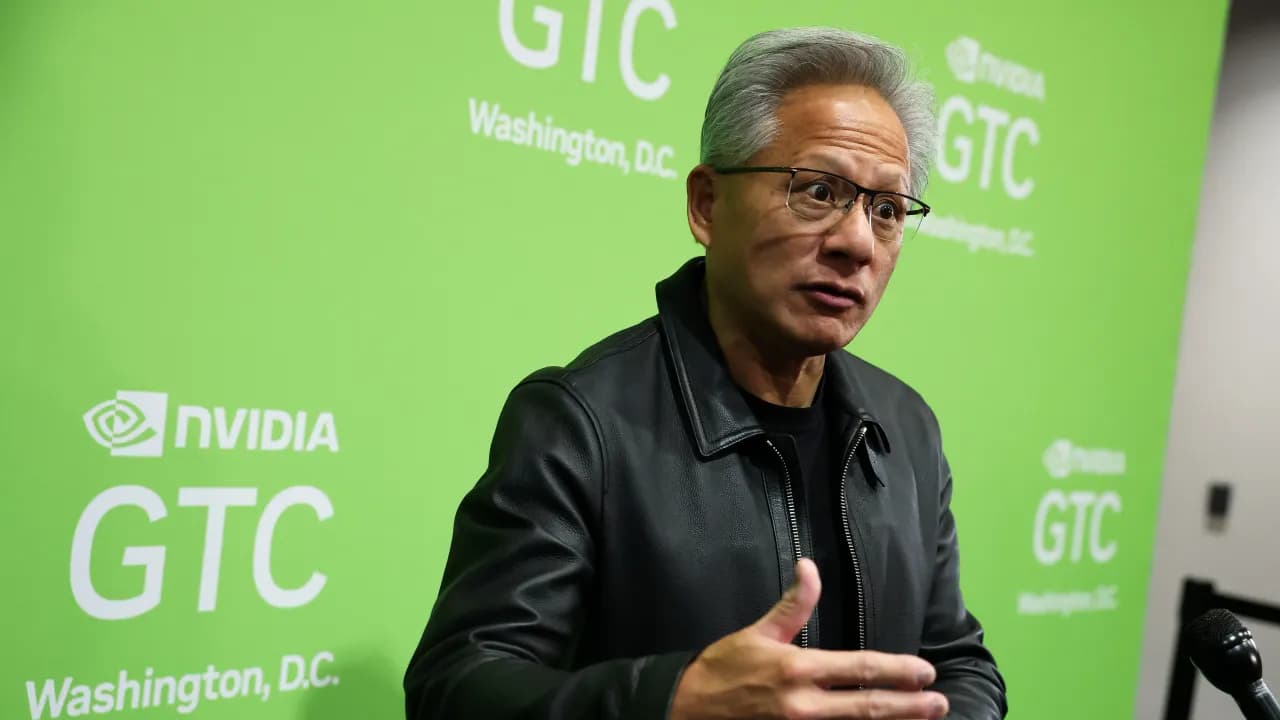

Multiple analysts on Wall Street have hiked their price targets on Nvidia’s stock after the slew of announcements made by the company at its annual GPU Technology Conference (GTC) in Washington on Tuesday.

NVDA’s stock was the top trending ticker on Stocktwits at the time of writing. Retail sentiment around the AI bellwether surged to ‘extremely bullish’ from ‘bullish’ territory, with chatter rising to ‘extremely high’ from ‘normal’ levels over the past day.

Wall Street Becomes More Bullish On Nvidia

Bank of America, UBS, Melius Research, and DA Davidson all increased their price targets on Nvidia’s stock on Wednesday, according to TheFly. UBS analyst Timothy Arcuri raised his price target to $235 from $205, while maintaining a ‘Buy’ rating on the shares. He noted Nvidia’s commentary suggests Street estimates remain too low ahead of earnings in three weeks.

Meanwhile, Melius Research raised its target to $300 from $275, projecting potential revenues exceeding $800 billion by decade-end.

Get updates to this developing story directly on Stocktwits.<

Read also: Bitcoin Slips Ahead Of Fed Rate Cut Decision — Ethereum, Dogecoin Lead Declines

For updates and corrections, email newsroom[at]stocktwits[dot]com.<