Nvidia and Intel continue to be on investors’ radar, with the former in the spotlight ahead of its quarterly results, and the latter grabbing attention due to its stake sale to the government.

Skepticism returned to Wall Street on Monday, leading to profit-taking in some stocks that had recently run up. The broader S&P 500 Index reversed course after snapping its five-session losing streak last Friday.

Amid the market volatility, the following stocks saw brisk activity in Monday’s extended session:

Nvidia Corp. (NVDA)

After-hours move: +0.27%

Trading volume: 6.97 million

Nvidia stock climbed 1.02% in Monday’s regular session, even as the broader market and the tech sector moved lower. The strength is attributable to twin price target hikes the stock received ahead of its fiscal year 2026 second-quarter results, due to be released Wednesday after the market closes.

While Baird bumped up the price target to $225 from $195, Stifel upped its by $10 to $212. Baird’s Tristan Gerra said the artificial intelligence (AI) GPU competitive landscape remains very favorable to Nvidia for the second half of the year and next year.

According to Fiscal.ai-compiled estimates, Nvidia is expected to report adjusted earnings per share (EPS) of $1.01 and revenue of $46 billion for the second quarter of the fiscal year 2026. This marks a sharp increase from the year-ago’s $0.68 and $30.04 billion, respectively.

Separately, IREN (IREN), a vertically integrated data center business powering Bitcoin and AI, among others, said it has procured an additional 4,200 NVIDIA Blackwell B200 GPUs.

On Stocktwits, retail sentiment toward Nvidia stock stayed ‘bullish’ (59/100) by late Monday, with the message volume at ‘high’ levels.

Nvidia stock has gained about 34% this year.

Intel Corp. (INTC)

After-hours move: -0.37%

Trading volume: 5.57 million

Intel’s stock has remained on investors’ radar ever since talks about the government taking a 10% stake surfaced. President Donald Trump and his administration, as well as the company, have since confirmed the rumor.

Intel said late Friday that the government will make an $8.9 billion investment in Intel common stock, with the government’s equity to be funded by the remaining $5.7 billion in grants previously awarded, but not paid yet, under the CHIPS Act, and $3.2 billion awarded as part of the Secure Enclave program.

The government stake has raised a few eyebrows among venture capital investors and strategists, who are opposing the move. In a post on X, economist Peter Schiff said, “Trump justified the U.S. government taking a stake in Intel and his intent to take similar stakes in other companies as just good business.”

“If he wanted to be a businessman, he should have stayed in the private sector. Constitutionally, presidents are not elected to do business.”

On Monday, the stock slid 1.01% to $24.55 after charting a broader uptrend in recent sessions. The stock has gained 22.44% year-to-date.

Retail sentiment toward the stock tempered to ‘bullish’ (69/100) from ‘extremely bullish,’ with the message volume remaining at ‘high’ levels.

Carnival Corp. (CCL)

After-hours move: +0.13%

Trading volume: 3.57 million

Shares of cruise company Carnival edged down 0.16% to $31.25 on Monday before slipping modestly in the extended session. The stock had closed at a multi-year high in the previous session.

Late Friday, the company disclosed in filings that Carnival Chairman Micky Arison bought shares in the company.

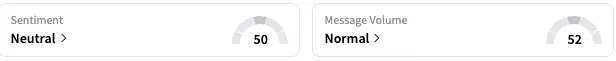

Carnival stock elicited a ‘neutral’ reaction (50/100) from Stocktwits users, and the message volume on the stream remained at ‘normal’ levels.

Comcast Corp. (CMCSA)

After-hours move: +0.41%

Trading volume: 2.82 million

Comcast stock fell 0.41% on Monday before rebounding in the after-hours session. Comcast, which owns NBC Universal, was at President Trump’s receiving end as he called upon the Federal Communications Commission (FCC) to revoke the station licenses of NBC and ABC, citing biased and mostly “bad” stories aired about him.

Trump also said these broadcasters should be required to pay millions of dollars in license fees for the broadcast spectrum they use.

Comcast stock attracted ‘bearish’ sentiment (30/100) from Stocktwits users, and the stream continued to see ‘low’ message volume.

The stock has lost about 7% year-to-date (YTD).

Lucid Group (LCID)

After-hours move: unchanged

Trading volume: 2.67 million

Lucid stock outperformed the broader market on Monday as investors positioned for the 1-for-10 reverse stock split that would take effect on Friday. The stock also benefited from Lucid’s announcement that lessees who opt to order Lucid Gravity luxury SUV by September and take deliveries before December 31 can still benefit from the $7,500 federal tax credit, which is set to expire by the end of September.

On Stocktwits, retail sentiment toward Lucid stock improved to ‘neutral’ (52/100) from ‘bearish’ a day ago, and the message volume also increased slightly to ‘normal’ levels.

Lucid’s stock has fallen over 31% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<