Cantor Fitzgerald analyst C.J. Muse noted that the AI infrastructure expansion is still in its early stages, driven largely by hyperscalers committing vast budgets.

NVIDIA Corp.(NVDA) saw a notable boost as Cantor Fitzgerald analyst C.J. Muse raised the firm’s price target to $300 from $240, while retaining an “Overweight” recommendation.

The price target hike follows Cantor’s in-depth discussions with Nvidia’s leadership team, according to TheFly.

Muse noted that the AI infrastructure expansion is still in its early stages, driven largely by hyperscalers committing vast budgets. He told investors, “This is not a bubble,” and said he sees long-term tailwinds far beyond current estimates.

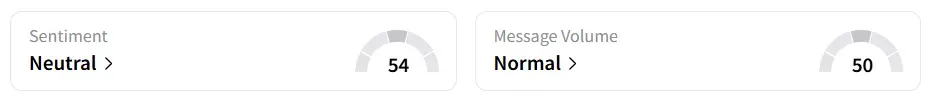

Nvidia stock traded over 2% higher on Thursday afternoon. On Stocktwits, retail sentiment around the stock improved to ‘neutral from ‘bearish’ territory the previous day amid ‘normal’ message volume levels.

According to the analyst, hyperscalers alone have visibility into hundreds of billions in demand over the next several years, excluding contributions from emerging “neo‑clouds,” enterprise AI adoption, and physical AI deployments. He believes Nvidia’s exposure to those growth points positions it well beyond the core infrastructure build-out. Muse expects Nvidia’s earnings per share (EPS) to reach $8 by 2026 and $11 by 2027.

In a further boost, the U.S. Commerce Department’s Bureau of Industry and Security (BIS) on Wednesday reportedly granted initial licenses for Nvidia to export chips to the United Arab Emirates.

According to the chip giant, for the third quarter (Q3) of fiscal 2026, it anticipates revenue of $54 billion, compared to the analysts’ consensus estimate of $54.6 billion, according to Fiscal AI data.

Nvidia’s stock has gained over 43% year-to-date and over 45% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<