vidia continues to make waves and struggling electric-vehicle maker Lucid’s reacted to the news of an imminent reverse stock split.

The benchmark S&P 500 index fell for a fifth straight day on Thursday, with new data showing strong private sector activity and extended tech weakness sapping risk appetite.

After the market closed, the following stocks saw brisk trading volumes in the extended session:

Nvidia Corp. (NVDA)

After-hours move: -0.10%

Trading volume: 8.83 million

Nvidia stock, which fell only modestly in Thursday’s extended session, steepened its losses in overnight trading after reports said the Jensen Huang-led company told component suppliers to suspend orders related to its H20 artificial intelligence (AI) chip for the Chinese market. Huang is reportedly in Taipei to visit foundry partner TSMC (TSM), and he told reporters that the company was in discussions with U.S. lawmakers regarding a successor to the H20 chips.

Retail traders on Stocktwits were divided over the stock trajectory, although the overall sentiment toward the stock remained ‘bullish’ and the message volume was at ‘normal’ levels.

Some rooted for the stock to cross the $200 level after next week’s earnings, while others saw risk stemming from the developments on AI chip exports to China.

Nvidia’s stock has gained over 30% this year.

Citigroup, Inc. (C)

After-hours move: +0.22%

Trading volume: 8.05 million

Investment and banking giant Citigroup was on investors’ radar sans a notable catalyst. The stock pulled back 0.62% in Thursday’s regular session, even as volumes were below average.

Financial stocks broadly are in the spotlight as the Federal Reserve is widely expected to cut interest rates in September. More clarity on the rate outlook would emerge when Fed Chair Jerome Powell takes the podium at the Jackson Hole conference on Friday.

Separately, the company recently hired law firm Paul Weiss to investigate complaints about its Wealth Management chief, Andy Sieg.

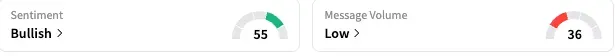

On Stocktwits, sentiment toward Citi stock remained ‘bullish’ (55/100) by late Thursday and the message volume, however, was at ‘low’ levels.

Citi’s stock is up more than 34% so far this year.

AT&T, Inc. (T)

After-hours move: +0.14%

Trading volume: 6.36 million

Telecom giant AT&T’s stock rose to a fresh high on Thursday amid increasing investor optimism about the company’s prospects in a challenging macro climate. FOMO (fear-of-missing-out) hit investors as they weighed in on potential opportunities such as the 5G infrastructure buildout.

Retail investors on Stocktwits called the stock a “safe haven,” while some said “time to cash out” following six straight sessions of gains.

In a note released Wednesday, BofA Securities stated it was adding AT&T to its “US 1 List,” a collection of the firm’s best investment ideas drawn from its Buy-rated stocks.

The sentiment meter read 68/100 for AT&T stock, suggesting a ‘bullish’ mood, and the message volume picked up, although to ‘normal’ levels.

The stock has gained nearly 34% so far this year.

Lucid Group, Inc. (LCID)

After-hours move: +0.48%

Trading volume: 4.42 million

Luxury electric-vehicle maker Lucid Group’s shares fell over 8% on Thursday. After the market closed, the company announced the effective date of its 1-for-10 reverse stock split, which shareholders had approved on Aug. 18. The split-adjusted stock will begin trading on Sept. 2.

Retail sentiment toward the stock stayed ‘bearish’ (35/100), accompanied by ‘low’ message volume.

Lucid stock has declined about 31% this year amid weakness in its business and the broader EV market.

Edward Lifesciences, Inc. (EW)

After-hours move: -0.20%

Trading volume: 3.55 million

The shares of the med-tech company, whose products and services treat advanced cardiovascular diseases, snapped their six-session winning streak on Thursday. The recent upward momentum was driven by the company’s announcement of a new $500-million share buyback plan.

The stock, which hit a new 52-week high of $83 in late July, ended Thursday at $81.16.

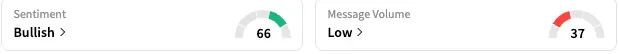

Edwards Lifesciences stock has continued to elicit ‘bullish’ sentiment (66/100) among retail investors on the Stocktwits platform, although the message volume has stayed at ‘low’ levels.

For the year-to-date period, the stock has lost about 10%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<