Analyst Ananda Baruah said the firm expects Nvidia’s shipments of graphics processing units (GPUs) to nearly double over the next 12 to 15 months.

- The new price target represents a 73% upside to Nvidia’s closing price as of Friday.

- Analyst Ananda Baruah said the firm expects Nvidia’s shipments of graphics processing units (GPUs) to nearly double over the next 12 to 15 months.

- Nvidia has $500 billion in Blackwell and Rubin revenue backlog through 2026.

NVIDIA Corp. (NVDA) could be on the verge of another growth phase as Loop Capital raised its price target on the chipmaker to $350 from $250, maintaining a ‘Buy’ rating. The new price target represents a 73% upside to Nvidia’s closing price as of Friday, according to TheFly.

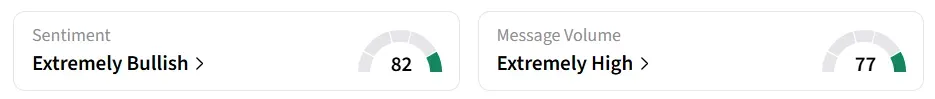

Nvidia’s stock traded over 1% higher in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Loop Capital Sees AI-Fueled Upside For Nvidia

Analyst Ananda Baruah of Loop Capital said the firm expects Nvidia’s shipments of graphics processing units (GPUs) to nearly double over the next 12 to 15 months, supported by rising demand for AI hardware and higher selling prices.

According to a CNBC report, Baruah projects that Nvidia will ship about 2.1 million GPUs by early 2026 as part of what he calls the “next Golden Wave” of Gen AI adoption.

“NVDA is at the front-end of another material leg of stranger-than-anticipated demand”.

-Ananda Baruah, Loop Capital

Goldman Sachs also raised the price target on Nvidia to $240 from $210 and reiterated a ‘Buy’ rating on the shares.

Blackwell Momentum

The chip behemoth’s stock has gained over 50% year-to-date. In his keynote address at the GTC conference in Washington, Huang disclosed that Nvidia has $500 billion in Blackwell and Rubin revenue backlog through 2026.

Also, Huang has reportedly stated that he remains optimistic about eventually selling the company’s new Blackwell AI chips in China.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<