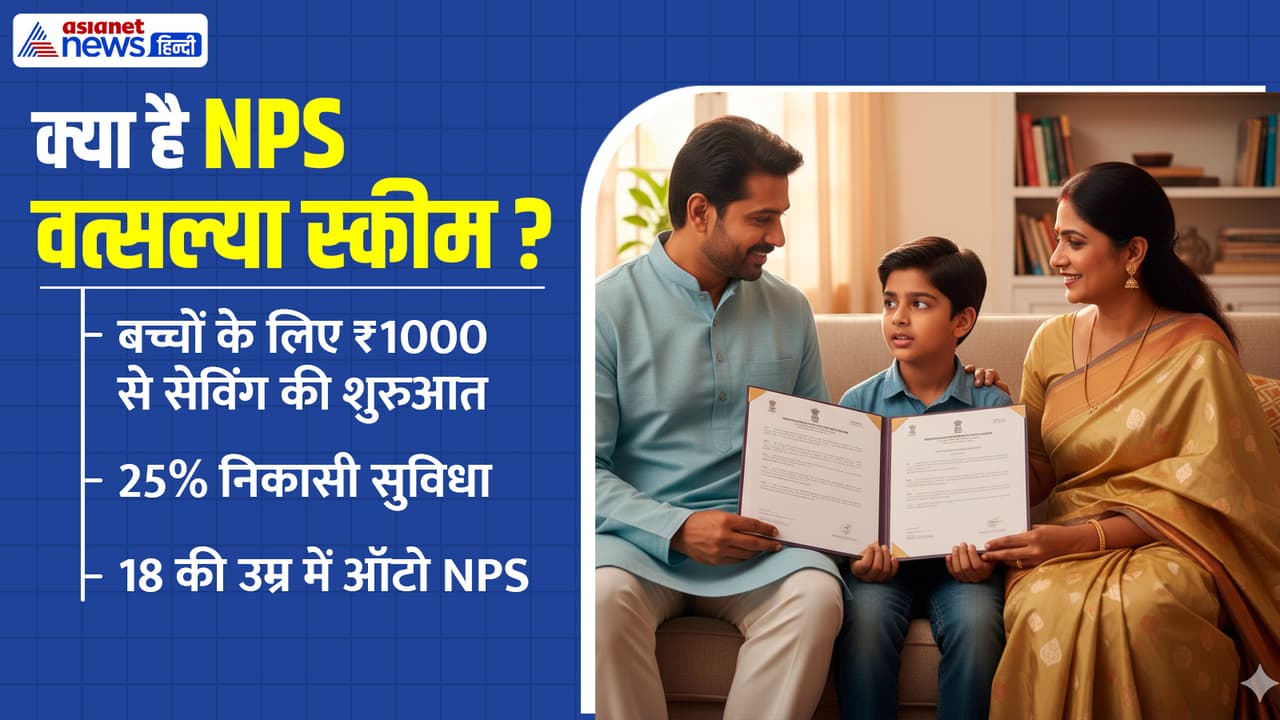

NPS Vatsalya Yojana: Under the NPS Vatsalya Scheme, parents can start saving by opening an account with 1000 rupees in the name of their children. The account at the age of 18 in the scheme will automatically turn to NPS Tier-I. Learn the application process and its benefits.

Nps vatsalya scheme: Many times, parents seek different savings plans to secure the future of children. But now the government has launched a scheme which not only opens the way for children’s retirement saving but also works in their essential needs like education and health. Its name is NPS Vatsalya Scheme, which was announced by the Finance Minister in Budget 2024-25. The most important thing about this scheme is that parents or parents can open an account in the name of a child and deposit at least 1000 rupees every year. There is no upper limit to insert money. Know what are the benefits of NPS Vatsalya Scheme. Essential details including how the account can open.

What are the benefits of NPS Vatsalya Yojana?

You can withdraw money even before the age of 18

If the child needs money, to treat a serious illness, or the child has more than 75 percent disability, then parents can withdraw up to 25 percent of the money from the account. This facility can be found up to three times, provided the account has completed at least three years.

As soon as 18 years are over, the account will change to NPS automatically

As soon as the child is 18 years old, this account will automatically turn into a normal NPS Tier-I account. That is, later the same account will continue to work for his retirement saving. For this, there will be no need to make any mess or new process.

Investment options in NPS Vatsalya Scheme

- Default Option- Moderate Lifecycle Fund (50 percent equity)

- Auto Option- Aggressive (75 percent equity), moderate (50 percent equity), conservative (25 percent equity)

- Active Option- Parents themselves can decide how much share goes to equity, government securities, corporate date or alternate asset.

What will happen if parents pass away?

If the child’s guardian dies, the new guardian can be registered with the KYC document. And if both parents pass away, then the guard-appointed guardian can also run this account for children.

Why is NPS Vatsalya Scheme?

- Retirement saving for children starts from an early age.

- Emergency like studies, disease and disability gives money to money.

- As soon as the completion of 18 years, the account automatically turns into a regular NPS account.

- Children get a lesson of financial planning and saving from a young age.

What will happen to the NPS account when the child is 18 years old?

As soon as the child is 18, the account will automatically turn to NPS Tier-I (All Citizen). Only the new KYC of the child has to be done. After this the child himself can decide whether he wants to stay in the scheme or get out.

When can I withdraw money from NPS Vatsalya account?

Even before the child turns 18, there is a facility of withdrawal of up to 25% in certain circumstances. For studies expenses, for treatment of serious illness or in a state of more than 75% disability. But this withdrawal can be done up to 3 times and will be possible only after at least 3 years after the account opens.

Document required to open an account

- Gargian base or driving license

- Child birth certificate or school certificate

- Gargian signature

- Passport for NRI or OCI, proof of foreign address and bank details

Also read- PM Vidyalaxmi Scheme: Merit admission in 860 institutions will get education loan, 3% interest subsidy

How to open NPS Vatsalya account?

- To open the online account, go to NPS Trust’s website npstrust.org.in.

- Click Open NPS Vatsalya.

- Enter the details of the guardian and the child.

- Do OTP Verification.

- Complete KYC and upload the baby’s dob proof.

- Choose an investment option.

- Make an initial contribution of at least 1000 rupees.

- The PRAN number will be generated and now you can save for your child as per your convenience.

Also read- Poor children from 9-12 will now study in luxury school, vigorous Central Government PM Yasasvi Scheme