NPCI is preparing to change the rules.

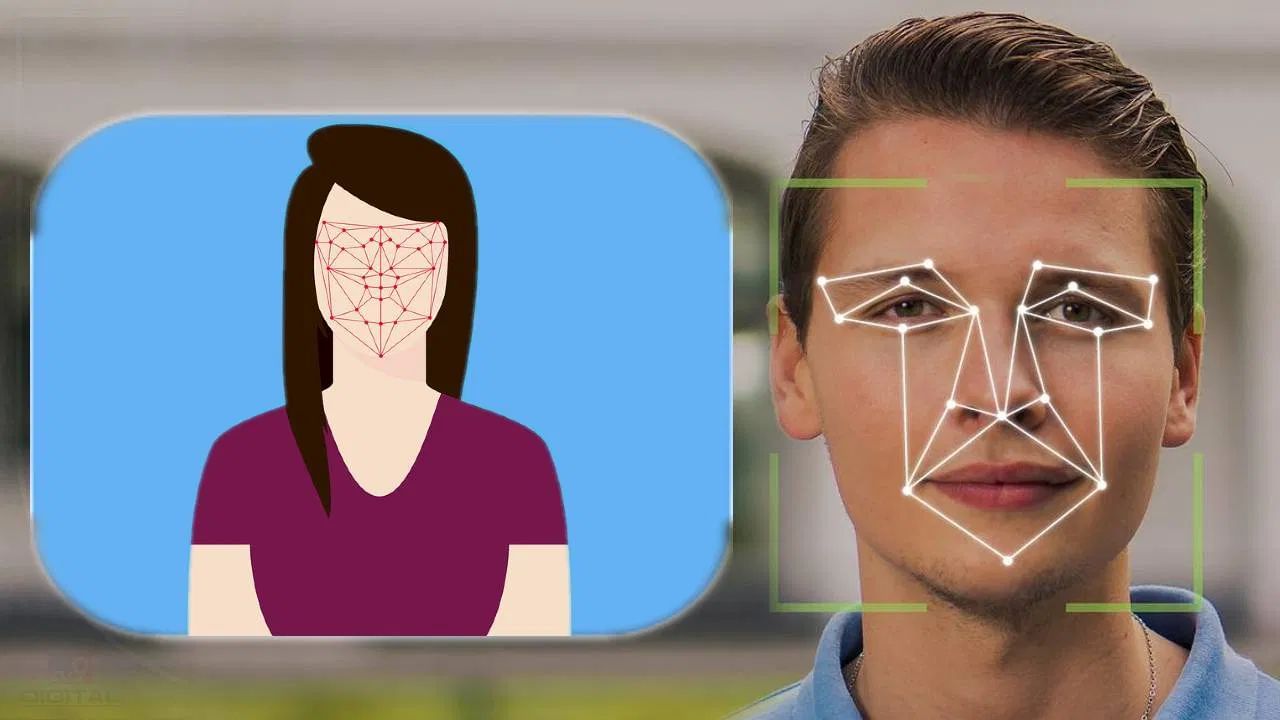

Giving information, a senior official of the Unique Identification Authority of India (UIDAI) said that the National Payment Corporation of India (NPCI) may soon allow Aadhaar based face authentication for high-value financial transactions. UIDAI Deputy Director General Abhishek Kumar Singh said during a group discussion in ‘Global Fintech Fest 2025’ that UIDAI is a infrastructure. This is definitely the only way to know who is, who is? We have the world’s largest biometric database. We strongly advocate the use of certification from the face in evaluation. Let us also tell you what kind of information has been given by UIDAI about this.

The easiest and fastest way

UIDAI Deputy Director General Abhishek Kumar Singh said that NPCI is already working on this idea and is expected to announce in this regard in the coming days. He also urged other bankers to join such a system and said that this is really the easiest and fastest way to certify someone. Given that the infrastructure of certification and framework device is associated with the device, he said that a special device is required to certify itself, except OTP part, if certification is being done through biometric processes.

Authentication will be from people’s mobiles

He said that according to a report that came three months ago, there are more than 64 crore smartphones in India, while the total device ecosystem is about 40 lakhs. He further said that as soon as we talk about identity from the face, your smartphone becomes your device and thus the device ecosystem suddenly exceeds 64 crores. He said that anyone gets such facility.

NPCI also made a big announcement

On the other hand, a big announcement has also been made by NPCI. According to the corporation, now the UPI light can be paid through the wearable smart glass in India. For this, users will only have to scan QR and give voice command. NPCI said on Tuesday that neither mobile phone will be required nor any PIN number will have to be recorded for this facility.

‘UPI Lite’ has been developed especially for repeated payments of small value and the dependence on the main banking system is very low in it. The NPCI has released a video stating that paying from UPI light on smart glass is just as comfortable like paying, paying.