Wall Street expects higher revenue but continued losses, with consensus estimates pointing to $3.14 billion in revenue and a loss per share.

- Investors are watching closely as Nio prepares to report quarterly results before the U.S. market opens on Nov. 25.

- Wall Street expects higher revenue but continued losses, with consensus estimates pointing to $3.14 billion in revenue and a loss per share.

- Retail traders on Stocktwits have flagged pressure for a stronger Q4 performance.

Nio, Inc. shares fell 0.8% in premarket trading on Wednesday, putting the stock at risk of extending its longest losing streak in nearly two years. Investors are watching closely ahead of the company’s quarterly results, which are due before the U.S. market opens on Nov.25.

Wall Street Sees Higher Revenue, Continued Losses

According to Koyfin consensus estimates, Nio is expected to report $3.14 billion in revenue for the upcoming quarter, compared with $2.65 billion a year earlier. EBITDA is forecast at a loss of $414.99 million, while EBIT is projected at a loss of $519.77 million, compared with a loss of $685.22 million a year ago. GAAP EPS is estimated at a loss of $0.23, compared with a loss of $0.32, and adjusted EPS is expected at a loss of $0.22, versus a loss of $0.26 previously.

Koyfin shows Nio’s average 12-month price target at $6.84, with forecasts ranging from $3.02 to $9.05. With shares last at $5.98, the average target implies about 14% potential upside. Analyst coverage includes 4 ‘Strong Buy’, 10 ‘Buy’, 11 ‘Hold’, 1 ‘Sell’, and 2 ‘Strong Sell’ ratings across 28 firms.

Bullish Analyst Calls

In September, BofA raised its price target on Nio to $7.60 from $7.10 and kept a ‘Neutral’ rating after Nio Day, noting the company built 3,500 power swap stations and established a network linking 20 major highways and 16 city clusters.

Citi lifted its target to $8.60 from $8.10 and maintained a ‘Buy’ rating, citing estimates that reflect strong orders for the L90 and ES8 and listing catalysts including a pickup in China’s new-energy vehicle demand, potential order upside, margin movement in the third quarter (Q3) and production ramps.

Mizuho also raised its target to $7 from $6 and kept a ‘Neutral’ rating, noting that U.S. tariffs were expected to have minimal impact on new vehicle prices.

Meanwhile, UBS upgraded Nio to ‘Buy’ from ‘Neutral’ with a target of $8.50, saying its newest products could further attract customers and projecting that Nio could reach free cash flow breakeven in 2026.

Firefly Begins Overseas Shipments

On Tuesday, Nio’s Firefly brand said it shipped its first batch of right-hand-drive vehicles to Singapore and plans to enter Thailand and the United Kingdom in 2026. Firefly CEO Daniel Jin said the brand would “significantly ramp up” efforts in markets without tariff barriers, naming Britain, Australia, New Zealand and Southeast Asia as priorities.

Firefly has sold 26,242 units in China since its December 2024 launch. Earlier this year, small batches were delivered to Norway, the Netherlands and Belgium, though expansion slowed following the European Commission’s tariff decision in late 2024.

Nio Boosts Deliveries Through Multi-Brand Strategy

Nio has added two lower-priced brands, Onvo and Firefly, to expand volumes amid intensifying EV competition. The group delivered 40,397 vehicles last month, nearly double the year-earlier figure. The company posted a second-quarter (Q2) net loss of $697.2 million but expects to break even in the fourth quarter.

Stocktwits Traders Flag Q4 Pressure

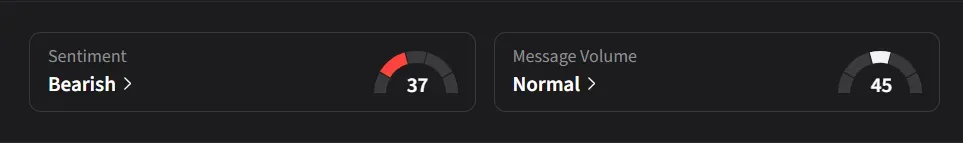

On Stocktwits, retail sentiment for Nio was ‘bearish’ amid ‘normal’ message volume.

One user said they expect little from Q3, but stressed that Q4 must show major improvement, noting that recent EPS trends put pressure on the company to deliver a stronger finish to the year. The user added that analysts “seemingly calling a bluff” and said Nio’s leadership needs tighter focus on the core business.

Another user said Nio’s “one mission, three brands and one scalable energy system” illustrates a strategy built around recurring revenue, customer lock-in, and wider infrastructure reach.

Nio’s U.S.-listed stock has declined 37% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<