Analysts say holding 24,344 support and clearing 24,595 resistance is key for a bullish reversal.

Nifty staged an impressive late-session recovery on Thursday, rebounding nearly 250 points from the intraday low and closing the weekly F&O expiry with modest gains. This recovery was primarily driven by strong domestic institutional investors (DII) buying ₹10,864 crore, which countered heavy foreign institutional investor (FII) selling worth ₹4,997 crore.

SEBI-registered analyst Mayank Singh Chandel noted that this reflected confidence from domestic institutions despite global tariff jitters, but bulls need to follow through.

What Is The Retail Mood?

Data on Stocktwits shows that retail sentiment turned ‘bullish’ on the Nifty yesterday amid ‘high’ message volumes.

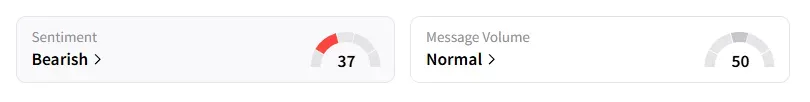

For the Bank Nifty, retail sentiment has been ‘bearish’ since July.

Technical Outlook

On the technical front, Chandel highlighted that the formation of a bullish candle with a long lower shadow on the daily chart shows strong buying interest from lower levels. He identified immediate support at 24,344 (yesterday’s low). A breakdown below this could drag the Nifty index towards the 200-day Exponential Moving Average (EMA) near 24,200, a level of critical technical importance.

On the upside, the 100-day EMA at 24,595 becomes the first hurdle. A sustained move above this could fuel momentum toward 24,672 (Wednesday’s high), and the 24,750–24,800 zone (key supply area with layered resistance), he added.

In other indicators, the Relative Strength Index (RSI) continues to hover near 39, holding a bearish crossover. Though in oversold territory, it hasn’t signaled a reversal yet and hence warrants cautious optimism, according to Chandel.

Since the price is currently battling around the 100 EMA, with the 50 EMA sloping downward, he believes that short-term trend pressure still leans bearish unless reclaimed convincingly. He concluded that a decisive move above 24,595 could change the tone back to neutral-to-bullish, while failure to hold 24,344 may resume weakness. The broader trend remains cautious unless key moving averages are reclaimed.

https://stocktwits.com/Ca_mscofficial/message/624180192

Key Levels To Watch

Pradeep Carpenter observed that the indices are below the 100-day Simple Moving Average (SMA) but holding above the 200-day SMA. As long as supports hold, bulls may retain control with key resistances ahead.

For the Nifty, he said that if the index breaks 24,650, it could gain till 24,750. Support is seen at 24,500, 24,450, and 24,350.

For Bank Nifty, resistance is seen at 55,700 and 55,900, with support at 55,300 and 55,000.

He highlighted that derivatives data shows maximum pain for the Nifty at 24,600 and for the Bank Nifty at 56,000.

https://stocktwits.com/PCRAnalyst/message/624177038

And Financial Sarthis pegged Nifty resistance at 24,662, 24,728, and 24,820 with support at 24,553, 24,498, and 24,432. For the Bank Nifty, they see resistance at 55,771, 56,019, 56.251 with support at 55,350, 55,07,4 and 54,731.

https://stocktwits.com/financialsarthis/message/624097801

For updates and corrections, email newsroom[at]stocktwits[dot]com.<