- Benchmark indices slipped, tracking weak global cues and trade uncertainty.

- Metals bucked the trend, while FMCG and banking counters weighed on indices.

- Global markets turned risk-averse ahead of US inflation data.

Indian equity markets ended lower on Friday amid profit booking and uncertainty over progress on the US-India trade deal. Speaking in Berlin, Commerce and Trade Minister Piyush Goyal said that India will not sign any trade deal in a hurry and also made it clear that India will not choose its trade partners at the behest of another country.

On Friday, the Sensex closed 344 points lower at 84,211, while the Nifty 50 ended down 96 points at 25,795. Broader markets also ended under pressure, with the Nifty Midcap and Smallcap indices ending 0.1% lower.

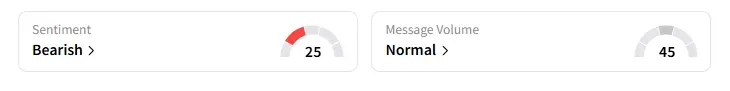

The retail investor sentiment surrounding the Nifty 50 moved from ‘extremely bearish’ to ‘bearish’ by market close on Stocktwits.

Stock Moves

Barring metals, real estate, and energy, the rest of the indices ended in the red. Cipla, HUL, and Ultratech Cement were among the top Nifty losers on Friday.

Colgate shares ended near their 52-week low after its Q2 earnings missed street estimates. On the other hand, Vakrangee rose 2% and PTC India saw its biggest single-day gain since July 2024 on strong Q2 performance.

Kotak Mahindra Bank ended 1% lower ahead of its Q2 earnings print tomorrow.

Aluminium stocks such as Hindalco (+4%), NALCO (+3%), and Vedanta (+2%) gained as prices on the London Metals Exchange (LME) climbed past $2,850 per tonne.

Utkarsh Small Finance Bank ended 17% higher after the company announced that it has allotted more than 5.71 crore shares to ace investor Madhusudan Kela’s fund house.

And Thyrocare ended 2% higher even as its promoter sold a 10% stake.

Markets: What Next?

Globally, European markets traded weak, while US stock futures indicate a subdued start on Wall Street ahead of crucial inflation data.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <