Effective Nov 21, 2025, the Code on Social Security, 2020 consolidates nine labour laws, extending benefits like insurance and gratuity to organised, unorganised, gig, and platform workers for the first time, aiming for efficient delivery.

The Code on Social Security, 2020, one of the four Labour Codes made effective from November 21, 2025, is enacted to consolidate and simplify the complex web of labour laws.

A Unified Social Security Framework

According to a government release, the Code consolidates nine existing labour laws into one comprehensive system to simplify compliance and extend benefits to organised, unorganised, gig, and platform workers.

The Code brings together life and disability insurance, health and maternity care, provident fund, and gratuity provisions under one umbrella, aiming to make welfare delivery more efficient and transparent through digital systems and streamlined procedures.

Expanded Benefits and Coverage

Gratuity and Fixed-Term Employment

Under the new law, fixed-term employees will now be entitled to gratuity after completing one year of continuous service, reducing the previous five-year requirement.

Inclusion of Gig and Platform Workers

For the first time, gig and platform workers will also receive social security benefits through schemes to be framed by the government. These schemes will be funded by contributions from the Centre, States, and aggregators, and monitored by a newly formed National Social Security Board.

Broader EPF Coverage and National Database

The Code extends coverage under the Employees’ Provident Fund to all establishments with 20 or more workers, irrespective of industry type, thereby expanding the safety net for millions.

It also mandates a National Database for Unorganised Workers through which each worker will receive a unique identification number linked with Aadhaar, allowing them to access benefits anywhere in the country.

Key Definitional and Policy Changes

Standardisation of ‘Wages’

To ensure uniformity, the definition of “wages” has been standardised across all labour laws. This change means that allowances such as bonuses and house rent will now count toward the wage calculation if they exceed 50 per cent of total pay. This is expected to enhance the value of social benefits like gratuity and pension.

Expansion of ESIC and Accident Coverage

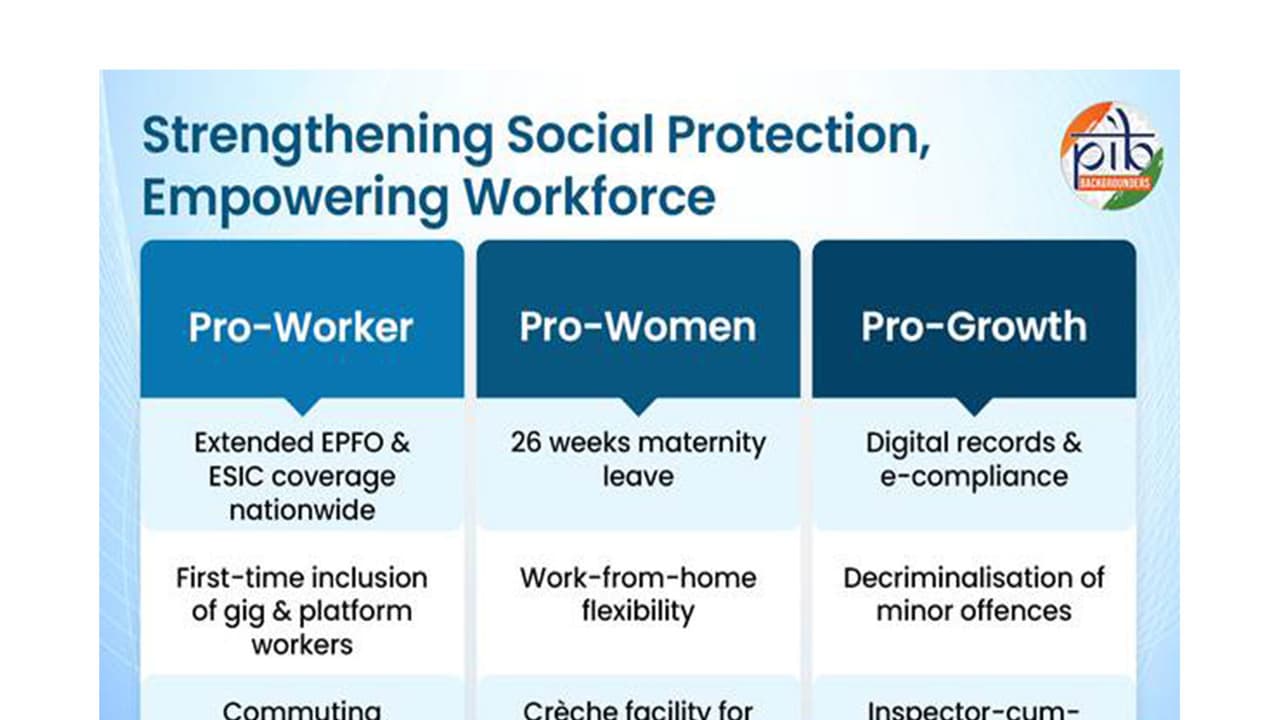

The Code also extends Employees’ State Insurance Corporation (ESIC) coverage to all parts of India and allows voluntary participation for smaller establishments. It further includes commuting accidents within the definition of employment-related injuries, ensuring compensation for affected workers or their families.

Pro-Women Initiatives

Women employees stand to gain from several pro-women provisions, including 26 weeks of paid maternity leave, 12 weeks for adoptive and commissioning mothers, nursing breaks, and the requirement of crèche facilities for establishments with 50 or more employees.

The option of work-from-home after maternity leave has also been introduced based on mutual agreement between the employer and employee.

Promoting Ease of Doing Business

The Code promotes ease of doing business by digitalising records, reducing compliance burdens, and replacing imprisonment with monetary fines for several offences. It introduces a five-year limit on initiating inquiries under the Employees’ Provident Fund, along with measures such as the compounding of offences to ensure quicker dispute resolution.

The Code reflects the Government’s commitment towards inclusive growth and social security for all, in line with the vision of a Viksit Bharat by 2047.

(Except for the headline, this story has not been edited by Asianet Newsable English staff and is published from a syndicated feed.)