- Netflix’s third-quarter revenue and EPS missed Wall Street targets.

- Evercore ISI said the stock’s 6% fall is due to the Brazilian tax issue and absence of 2026 guidance.

- Piper Sandler analyst Thomas Champion revised the firm’s price target down to $1,400 from $1,500.

Netflix Inc. (NFLX) stock was in the spotlight on Wednesday morning after the streaming giant’s third-quarter (Q3) revenue and earnings per share (EPS) fell short of Wall Street expectations and prompted analysts to slash price targets.

The company’s Q3 revenue of $11.51 billion and EPS of $5.87 both missed the analysts’ consensus estimate of $11.52 billion and $6.95, respectively, according to Fiscal AI data.

Minor Revenue Miss Triggers Major Stock Reaction

Evercore ISI pointed out that the streaming giant’s revenue missed estimates by just 0.1%, marking the first such shortfall in two years. Despite the minor scale of the miss, the firm noted it had an outsized impact due to Netflix’s subscription-based model, which tends to show minimal volatility in earnings from quarter to quarter.

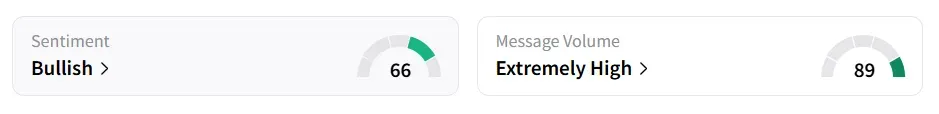

Netflix stock traded over 6% lower in Wednesday’s premarket and was among the top five trending tickers on Stocktwits. Retail sentiment around the stock remained in ‘bullish’ territory, and message volume improved to ‘extremely high’ from ‘normal’ levels in 24 hours.

According to Evercore, the 6% drop in the stock stemmed from the revenue miss, an unexpected Brazil-related tax expense, and the lack of any guidance for 2026.

Meanwhile, Piper Sandler analyst Thomas Champion revised the firm’s price target down to $1,400 from $1,500, though he kept an ‘Overweight’ rating on the stock. He characterized the Q3 results as “mixed,” citing in-line sales but weaker-than-expected operating income, largely due to a $619 million tax accrual tied to a dispute in Brazil.

Get updates to this developing story directly on Stocktwits.<