The analyst expects the upmove to continue if the stock breaks above ₹1,300.

Nestle India’s shares surged 5% in afternoon trade to their highest levels in four months, after the company’s domestic business grew over 10%.

The stock climbed to ₹1,286.5 after the results.

Domestic Sales Hit Record Highs Even As Profit Sinks

Nestle India reported a 23.6% year-on-year (YoY) decline in standalone net profit to ₹753.2 crore for the July–September quarter of FY26. Revenue from operations rose 10.6% to ₹5,643.6 crore, driven by strong domestic demand and double-digit growth across most product categories.

The decline in profit was largely due to elevated input costs, particularly higher cocoa and milk prices, which weighed on margins amid rising operating expenses during the festive season, the company said.

On a consolidated basis, net profit fell 17% to ₹743 crore, while revenue rose 10% to ₹5,645 crore.

Domestic sales reached a record ₹5,411 crore, up 10.8% supported by broad-based volume growth. Chairman and Managing Director Manish Tiwary said three of four product groups posted double-digit growth, adding that recent GST amendments could boost consumption.

Breakout Above ₹1,300 could Lead To Further Gains

Nestlé India’s stock has shown a strong technical rebound from its 200-exponential moving average (EMA) support at ₹1,093, closing decisively above the key resistance zone of ₹1,250 – ₹1,270, according to SEBI-registered Finkhoz RoboAdvisory.

A breakout above ₹1,300 could pave the way for further upside, with potential targets at ₹1,330, ₹1,390, and ₹1,450, it said.

The relative strength index (RSI) reading of 61 reflects underlying strength and room for continuation, while the stock’s formation of higher lows since July indicates a positive trend structure. However, a brief price cool-off cannot be ruled out, making it prudent to wait for a minor correction before fresh entries. Stop-loss is advised at ₹1,150.

Nestle Trends On Stocktwits

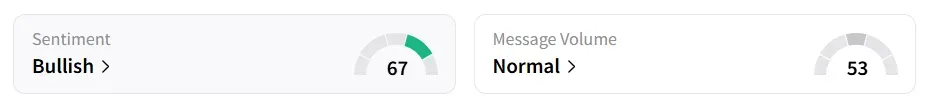

Retail sentiment remained ‘bullish’. It was ‘neutral’ last week. Nestle was also among the top three trending stocks on the platform.

Year-to-date (YTD), the stock gained 17.6%

For updates and corrections, email newsroom[at]stocktwits[dot]com. <