The tech giant’s cloud-computing unit, Azure, posted a 38% growth, below the 39% increase in the same period last year.

- The tech giant reported its second-quarter (Q2) results on Wednesday, posting a revenue of $81.3 billion and earnings per share (EPS) of $4.14, both exceeding estimates.

- Deutsche Bank and BMO capital analysts said Azure growth and guidance fell short of market expectations.

- Stifel analyst Brad Reback increased his price target to $540 from $520, keeping a ‘Buy’ rating.

Microsoft Corp. (MSFT) stock is drawing attention on Friday as retail investors remain optimistic about its growth despite it tumbling 10% on Thursday, its biggest fall since 2020.

The tech giant reported its second-quarter (Q2) results on Wednesday, posting a revenue of $81.3 billion and earnings per share (EPS) of $4.14. Both revenue and EPS exceeded the analysts’ consensus estimate of $80.25 billion and $3.95, respectively, according to Fiscal AI data.

However, the stock fell as the company’s cloud-computing unit, Azure, reported a 38% growth, below the 39% increase in the same period last year. In Friday’s premarket, Microsoft stock inched 0.8% higher.

What Are Stocktwits Users Saying?

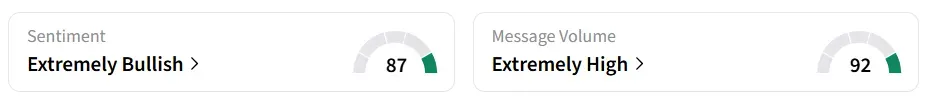

On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

A Stocktwits user believes Microsoft’s price decline is a gift to investors.

Another user expressed optimism about the stock’s long-term potential.

One user called the company’s current valuation multiple fair.

How Did The Street React?

Deutsche Bank analyst Brad Zelnick lowered Microsoft’s price target to $575 from $630 but retained a ‘Buy’ rating, according to TheFly. He noted the company delivered solid fiscal Q2 results, although Azure growth did not meet what he described as “more lofty” market expectations.

Meanwhile, Stifel analyst Brad Reback increased his price target to $540 from $520, keeping a ‘Buy’ rating, citing capacity constraints in Azure and a lack of near-term acceleration due to management balancing datacenter resources among internal apps, research and development, and customer demand.

BMO Capital analyst Keith Bachman reduced the firm’s price target to $575 from $625 while maintaining an ‘Outperform’ rating. He highlighted that the Q2 Azure growth of 38% and Q3 guidance of 37% to 38% fell slightly short of expectations, noting that the market likely anticipated 1 to 2 percentage points of higher growth.

MSFT stock has gained over 4% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<