The Wall Street lender’s top boss said that asset managers were underweight on China when times were tough, and that it has once again become a destination for investment.

- “When the animal spirits are kicking in and when there is a clear advantage being struck by winning companies, they want alpha,” — Pick.

- Earlier, Goldman Sachs CEO David Solomon said that there is a greater appetite for investments in Chinese companies than 12 months ago, after valuations became more attractive.

- Pick further stated that China is offering a blueprint to its neighbor, India, to build its own global industry champions and homegrown leaders.

Morgan Stanley CEO Ted Pick reportedly said on Tuesday that China has held its place as a top draw for global asset managers amid a return of confidence, with investors agreeing that the world’s second-most liquid market is too big to ignore.

According to a Bloomberg News report citing a television interview with Pick, the Wall Street lender’s top boss said that asset managers were underweight on China, with exposure becoming more passive and beta-driven when times were tough, and that it has once again become a destination for investment, with momentum returning.

Wall Street CEOs Acknowledge Return Of The ‘Alpha’

Speaking on the sidelines of Hong Kong’s annual financial summit, Pick joined a rising number of Wall Street banks and asset managers to express enthusiasm for the world’s second biggest economy after a few years of slowdown following strict pandemic restrictions, regulatory crackdowns, and real estate turmoil.

Beijing has stepped in increasingly to bolster economic growth by injecting liquidity, easing foreign inflows, and offering incentives to boost consumption amid the uncertain economic policies of the Trump administration, which have affected its exports.

“When the animal spirits are kicking in and when there is a clear advantage being struck by winning companies, they want alpha,” Pick reportedly said. “They want company-specific allocations — that’s when the new-issue environment becomes so important.”

The iShares China Large-Cap ETF has jumped 32.6% this year, and the iShares MSCI China ETF has risen over 37%. This compares with nearly 16% gains in the SPDR S&P 500 ETF and over 22% rise in Invesco QQQ Trust Series 1 ETF, which tracks the Nasdaq 100 companies.

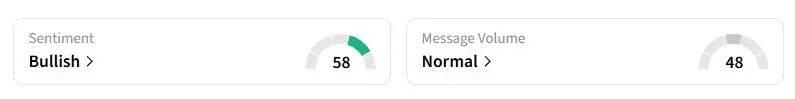

Retail sentiment on Stocktwits about the iShares China Large-Cap ETF (FXI) was in the ‘bullish’ territory at the time of writing.

Earlier, Goldman Sachs CEO David Solomon said that there is a greater appetite for investments in Chinese companies than 12 months ago, after valuations became more attractive.

India Moving Beyond ‘Plus-One’ Status

Pick further stated that China is offering a blueprint to its neighbor, India, to build its own global industry champions and homegrown leaders that can transform its economy. Asia’s third-largest economy is learning to move beyond its “plus-one” status and begin creating its own international leaders, he reportedly added.

He added that for Morgan Stanley, the two markets are among the most exciting places to operate, with each offering scale, ambition, and a growing roster of companies ready to compete on the world stage. “I like India, but I like China. You don’t have to make the choice,” he said.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<