Needham analyst Serge Belanger lowered the firm’s price target on the stock to $20 from $66 but kept a ‘Buy’ rating on the shares.

Shares of MoonLake Immunotherapeutics (MLTX) rebounded 14% on Tuesday after a near 90% plunge on Monday.

MoonLake on Sunday announced 16-week results from its late-stage VELA-1 and VELA-2 identical trials of Sonelokimab in patients with moderate-to-severe hidradenitis suppurativa (HS), also known as acne inversa — a chronic inflammatory condition characterized by painful, boil-like nodules that can rupture, drain pus, and leave scars.

In VELA-1, Sonelokimab achieved statistical significance for all primary and key secondary endpoints, including a substantial improvement in the disease. However, in VELA-2, the drug failed to achieve statistical significance. Subsequently, on Monday, MLTX closed at $6.25, marking its lowest levels in over three years. The stock is currently trading at $7.41.

The mixed data drew several price target cuts. Needham analyst Serge Belanger lowered the firm’s price target on MoonLake Immunotherapeutics to $20 from $66 on Tuesday, but maintained a ‘Buy’ rating on the shares. The regulatory path looks uncertain, and MoonLake might need to conduct another late-stage trial in the worst-case scenario, the analyst noted.

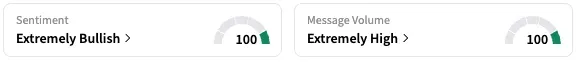

On Stocktwits, retail sentiment around MLTX stock remained within the ‘extremely bullish’ territory over the past 24 hours, while message volume stayed at ‘extremely high’ levels.

A Stocktwits user expects the stock to rise further.

Another noted that, although analysts have cut price targets, several targets remain higher than current trading levels.

Guggenheim also lowered the firm’s price target on the stock to $20 from $80 and kept a ‘Buy’ rating on the shares. While investors are now focused on the drug’s regulatory path, the firm noted that MoonLake is conducting multiple clinical studies across other indications, including palmoplantar pustulosis, psoriatic arthritis, and axial spondyloarthritis. These together sum up to a multibillion-dollar market, the firm noted.

Citi analyst Samantha Semenkow, meanwhile, downgraded MoonLake Immunotherapeutics to ‘Neutral’ from ‘Buy’ with a price target of $5, down from $72, on “significant” regulatory risk for the drug. The analyst also noted that Moonlake is currently facing financing challenges.

MLTX stock is down by 89% this year.

Read also: AnaptysBio Stock Gets A Price Target Hike After Announcing Plan To Separate Royalty, Biopharma Businesses – Check Out The New Level

For updates and corrections, email newsroom[at]stocktwits[dot]com.<