Mizuho said Meta’s reported metaverse spending cuts could boost earnings and set the stage for further upside in the stock.

- Mizuho says deep metaverse cuts could lift Meta’s 2026 earnings forecast by roughly $2 per share.

- The firm argues reducing Reality Labs’ losses would ease a drag on profitability.

- Mizuho believes the spending reset strengthens confidence in Meta’s pivot toward generative AI.

Mizuho said Meta Platforms could be positioned for a “significant rally ahead,” arguing that the company’s reported pullback in metaverse spending marks a shift that could reshape its earnings outlook and address long-running investor concerns.

Metaverse Pullback Could Lift Earnings

Mizuho estimated that cutting metaverse spending by as much as 30% could add around $2 per share to its 2026 earnings forecast of $29.50. The brokerage noted that Reality Labs’ losses currently weigh on earnings by nearly $5.85 per share and said reducing that burden should give investors greater confidence that Meta’s aggressive pivot toward generative AI will not become “a blank check forever.” Mizuho reiterated its ‘Outperform’ rating and $815 price target on Meta.

Meta Mulls Up To 30% Cuts Across Metaverse

Meta is reportedly weighing budget reductions of as much as 30% across its metaverse group next year as part of its 2026 planning cycle. The proposals were reviewed at Mark Zuckerberg’s Hawaii compound last month, where executives also discussed plans to trim about 10% of spending across broader teams, according to a Bloomberg report.

Most of the reductions would fall on Meta’s virtual reality operations, which account for the bulk of Reality Labs’ costs, along with Horizon Worlds. Layoffs could reportedly begin as early as January if the deepest cuts proceed, though no final decision has been made.

Long-Running Metaverse Losses

Reality Labs has accumulated more than $70 billion in losses since early 2021 and drawn scrutiny from regulators and investors over safety concerns, low engagement and the scale of Meta’s spending. Despite Zuckerberg’s conviction that virtual worlds would become a dominant computing platform, adoption has not met expectations.

Zuckerberg’s Attention Shifts To AI And Hardware

Zuckerberg has increasingly highlighted Meta’s generative AI efforts, including its Llama models, Meta AI assistant and the company’s AI-enabled Ray-Ban smart glasses. Meta also recently hired Apple’s former top design executive to strengthen its consumer hardware push and is planning new launches internationally, including in London in 2026.

Stocktwits Traders Applaud Spending Pullback

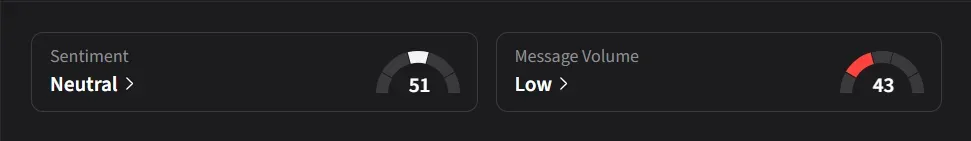

On Stocktwits, retail sentiment was ‘neutral’ amid ‘low’ message volume.

One user said, “$4.4 billion net loss last quarter. It’s a good thing Mark came to his senses and cut the Metaverse budget.”

Another user said the stock could now push toward $800, arguing that capex concerns have been addressed and that institutional inflows could increase following the dividend announcement.

Meta’s stock has risen nearly 14% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<