Kolkata: Mutual fund investments has been growing at a blistering pace in India. Many are not only investing a significant share of their monthly salary into mutual funds but also taking out money from fixed deposits and putting it in mutual funds — all for the sake of pocketing inflation-beating returns. Despite the impressive growth of the mutual fund industry, there is an immense unrealized potential for this industry feel experts.

To get an idea of how big the possibility of the Indian mutual fund industry is, one can have a look at the size of the American mutual fund sector. AMFI figures tell us that the Indian mutual fund industry had total AUM (Assets Under Management) of Rs 75.36 trillion (or about $903 billion). On the other hand, the mutual fund industry in the US has an AUM of about $34.58 trillion (in 2024). In other words, the US market is about 38,250 times bigger than the Indian MF industry.

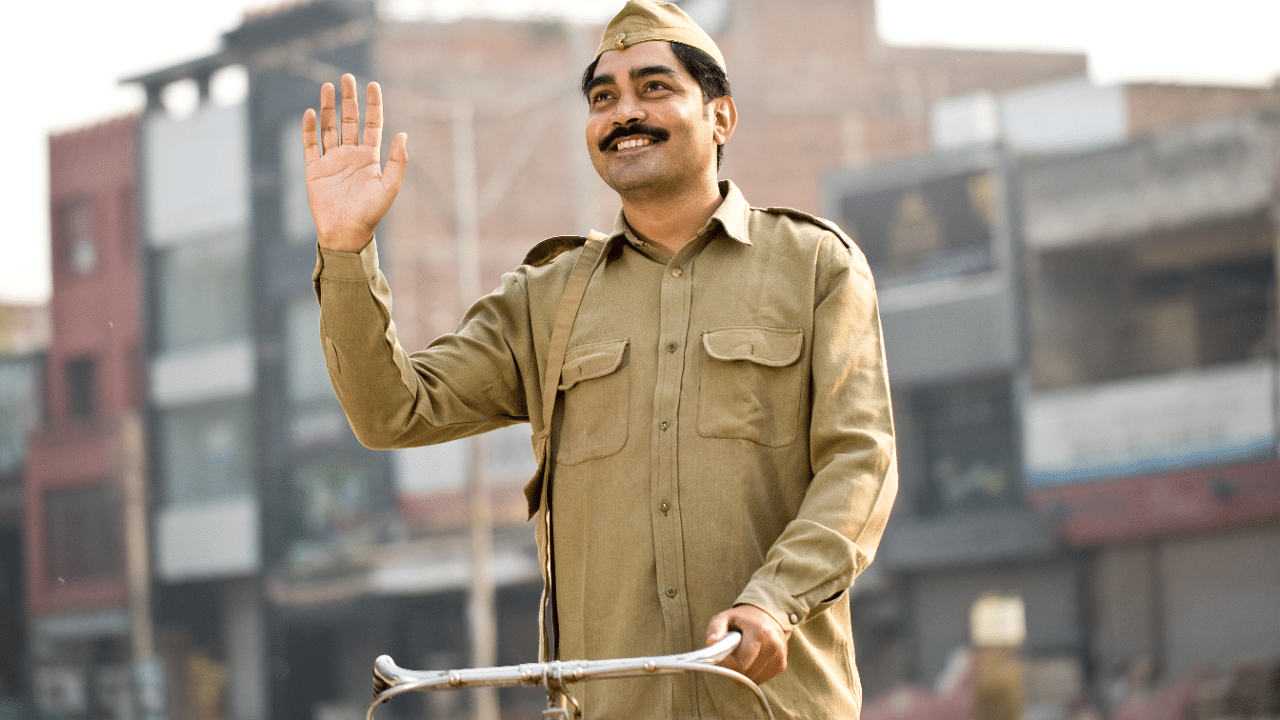

Who will train the postmen

In order to expand the reach of the mutual fund industry overnight, plans are now afoot to train postmen into mutual fund distributors. The Association of Mutual Funds in India (AMFI) has tied up with India Post to impart the necessary training to nearly one lakh postmen in a step that is expected to double the investor base. The plan has zeroed in on four states for a beginning and the target is to cover every district with 10 such distributors by the end of December 2025.

These four states are Meghalaya, Bihar, Odisha and Andhra Pradesh. According to reports, National Institute of Securities Market will impart the special training programme to the postmen who will work as MF distributors. This will also make them part-time entrepreneurs.

Venkat Chalasani, CEO, AMFI has told the media that they have initiated talks with the postal department. The first step is in gauging the level of interest of the postmen to undergo the training and start working as MF intermediaries. The AMFI CEO emphasised that the postmen, by the virtue of their work, are in regular touch with the common people in smaller towns. They also are aware of the what the common people wants and. therefore, they are in a position to tap the household savings of the common person.

Distributor strength

According to reports, the Indian mutual fund industry has 1.78 lakh distributors, including 1.62 lakh individual distributors. IN the past five years, the number of MF distributors has risen in tandem with the growth of the industry. About 1.04 lakh individual distributors have been added. Though investing directly into mutual fund schemes has become possible (without involving any distributor at all), thanks to the tech-intensive digital platforms, these are mainly concentrated in the urban areas and presupposes that the investor is not only conversant with the intricacies of the mutual fund industry and his/her own requirements but also comfortable with using internet-based investment platforms.

(Disclaimer: This article is only meant to provide information. TV9 does not recommend buying or selling shares or subscriptions of any IPO, Mutual Funds, precious metals, commodity, REITs, INVITs, any form of alternative investment instruments and crypto assets.)