The newfound optimism toward Microvast could be traced back to the ongoing wrangling between the U.S. and China over the latter’s curbs on the export of rare earths, which are used for making battery materials.

Shares of electric-vehicle (EV) battery manufacturer and storage solutions company Microvast Holdings, Inc. (MVST) are poised to open higher on Thursday, setting them on course for a fourth straight session of gains.

In the early premarket session, MVST stock climbed over 12% and is inching closer to the psychological barrier of $7, which it has not cleared since March 2022. So far this week, the stock has gained 44%, with the year-to-date gains at 202%. The stock was the top trending equity ticker on Stocktwits early Thursday.

The newfound optimism toward Microvast could be traced back to the ongoing wrangling between the U.S. and China over the latter’s curbs on the export of rare earths, which are used for making battery materials.

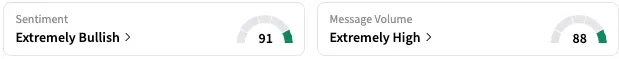

On Stocktwits, retail sentiment toward MVST stock moved further into the ‘extremely bullish’ territory, as of early Thursday, with the message volume at ‘extremely high’ levels.

The stock is receiving strong support from retailers on Stocktwits, with one user suggesting it’s time for the stock to reach the $10 level.

Another user said he was accumulating MVST stock, alongside other similar-sized “pillars of investment, grounded in reality of the company’s assets, IP, and global infrastructure.”

A third user sounded even more bullish. Calling MVST a value stock, they, however, warned of a potential correction on the horizon. While noting that many stocks traded with a market cap of over $20 billion and no revenue, they said MVST’s market cap was no longer showing fair value. “This is no longer a meme name,” they added. Based on Wednesday’s closing price, the company has a market cap of $2.033 billion, placing it in the small-cap category.

Wall Street analysts, however, are not optimistic about MVST’s stock trajectory, with the Koyfin-compiled consensus analysts’ price target at $5.50. This implies roughly 12% downside from the closing price on Wednesday. to Koyfin, the short interest in MVST stock is at 10.70%, the highest in more than four years, making it an ideal candidate for a short-squeeze rally.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<