According to a report from CNBC, Piper Sandler said in a note to investors that it thinks Microsoft is still a big winner in the AI trade.

- Piper Sandler said that respondents in its second-half 2025 CIO survey were positive on both Azure and Copilot activity. \

- The analyst said the market should buy on the pullback post-F2Q26 results.

- The analyst also said that AI demand would continue to outpace supply in 2026 and 2027, which would in turn boost Azure and Microsoft Copilot adoption.

Shares of Microsoft Corp. (MSFT) have declined sharply in the past month, slipping further after the company reported its second-quarter (Q2) 2026 results on Jan. 28. Yet, Piper Sandler has reportedly named the stock as a top pick in software.

According to a report from CNBC, Piper Sandler said in a note to investors that it thinks Microsoft is still a big winner in the AI trade.

The analyst has a price target of $600 on Microsoft and an ‘Overweight’ rating on the shares.

“We see Microsoft as perhaps the best pure-play on AI adoption today,” analyst Billy Fitzsimmons said in a note, as per the report.

Analyst Rationale

Piper Sandler said that respondents in its second-half 2025 CIO survey were positive on both Azure and Copilot activity. “We should be buyers on the pullback post-F2Q26 results,” Fitzsimmons reportedly said in the note.

The analyst also said in the note that AI demand would continue to outpace supply in 2026 and 2027, which would in turn boost Azure and Microsoft Copilot adoption, as per the report. While Piper Sandler noted concerns around AI adoption in the software sector, the analyst said that Microsoft would be able to afford adapting to the technology.

“We believe Microsoft is best positioned to benefit from the elevated AI infrastructure spending,” Fitzsimmons reportedly said in the note. He also added that the firm believes Microsoft was better-positioned financially than its peers to undertake required capital expenditures.

Q2 Results

Last week, Microsoft posted its Q2 2026 earnings results, with revenue of $81.3 billion, which was 17% higher than the same period last year and exceeded street expectations of $80.25 billion as per data from Fiscal.ai.

Earnings also beat consensus. The software maker posted earnings per share of $4.14, up 24% year-on-year, and ahead of estimates of $3.95, as per Fiscal.ai data.

However, the growth of its cloud-computing unit, Azure, declined marginally. Azure posted a 38% growth in sales for the latest quarter, compared to 39% growth in the same period last year.

How Did Stocktwits Users React?

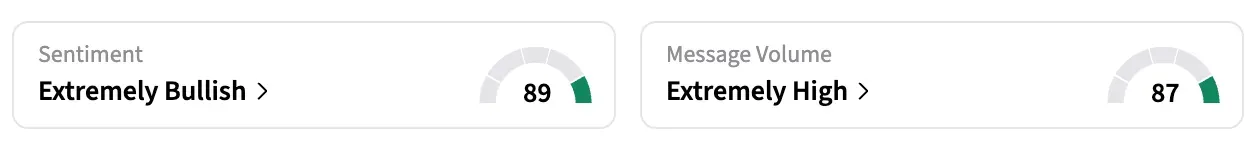

On Stocktwits, retail sentiment for MSFT shares was in the ‘extremely bullish’ territory over the past 24 hours, amid ‘extremely high’ message volumes.

Shares of MSFT have gained 0.11% in the past year, at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Also Read: MRVL Stock Slumps After Celestial AI Acquisition — What Does The Street Think?