The stock fell 14.6% over the last week, logging the seventh consecutive week of declines.

- Last week, JPMorgan analysts cautioned that the stock faces risk if MSCI decides to exclude digital asset treasury companies from its various indexes.

- Saylor has been in a defiant mood and doubled down on Strategy’s bet by noting Sunday that he “won’t back down.”

- JPMorgan boycott calls grew on X, with several cryptocurrency advocates throwing their weight behind the initiative.

Strategy (MSTR) Chair Michael Saylor struck a defiant tone over the weekend amid growing skepticism around the biggest corporate holder of Bitcoin.

The stock fell 14.6% over the last week, logging the seventh consecutive week of declines. Investors will now keenly await the company’s update on its Bitcoin holdings, expected on Monday, to see whether the firm bought more Bitcoin amid the price declines of the apex cryptocurrency last week.

What Did Saylor Say?

Last week, JPMorgan analysts cautioned that the stock faces risk if MSCI decides to exclude digital asset treasury companies from its various indexes. The warnings came as the popular investment research firm MSCI, formerly known as Morgan Stanley Capital International, was set to decide whether to remove digital asset treasury companies from its indexes. A removal could cause a selloff with funds tracking the indexes, reducing their exposure to the Strategy.

JPMorgan estimated Strategy’s shares could face roughly $2.8 billion in forced selling if it’s dropped from MSCI indexes such as MSCI USA and MSCI World — and as much as $8.8 billion if other index providers like Russell follow suit.

However, Saylor has been in a defiant mood and doubled down on Strategy’s bet, posting that he “won’t back down” on X. Last week, the firm acquired 8,178 Bitcoin for $835.6 million, bringing its total Bitcoin holdings to 649,870.

“Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin (BTC) as productive capital,” Saylor wrote on X on Friday.

Later, in an interview with CoinDesk, he labeled the crypto market’s volatility “vitality” and dubbed the recent drop “Satoshi’s gift to the faithful,” a reference to the mysterious creator of the biggest cryptocurrency.

JPMorgan Boycott Calls Grow Amid Crypto Enthusiasts

Amid the uncertainty, cryptocurrency traders began calling for a boycott of JPMorgan & Chase, the biggest U.S. bank, following its publication of a research note that highlighted concerns about MSCI’s exclusion. “I just pulled $20M from Chase and suing them for credit card malfeasance,” real estate investor and Bitcoin advocate Grant Cardone said in a post on X.

“Legacy banks want a war with #Bitcoin and still expect your deposits. Leave them behind,” posted Truth for the Commoner, a Bitcoin-focused media company with nearly 90,000 followers on X.

JPMorgan CEO Jamie Dimon, along with many on Wall Street, has previously expressed apprehension about adopting cryptocurrencies. Dimon called them a “fraud” back in 2017. Their stance has changed notably in recent times.

Last month, a report said that the bank is considering allowing clients to use Bitcoin (BTC) and Ethereum (ETH) as collateral for loans by the end of the year. The bank already allows crypto-linked exchange-traded funds (ETFs) to be pledged as collateral. The expansion to direct cryptocurrency holdings marks another step in integrating digital assets into traditional finance.

What Is Retail Thinking?

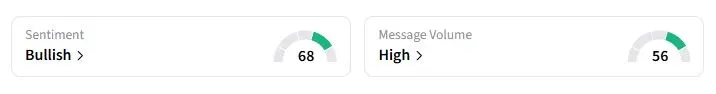

Retail sentiment on Stocktwits about JPMorgan was in the ‘bullish’ territory, while traders were ‘neutral’ about Bitcoin.

JPMorgan stock has gained 23.7% this year, while Bitcoin has fallen over 6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<