Meta’s ad-driven revenue growth remains robust, but heavy AI spending, tax-related earnings volatility, and accounting concerns have weighed on investor confidence.

- Massive data-center investments underpin Meta’s AGI ambitions, yet lagging LLM performance and rising capex continue to test investor patience.

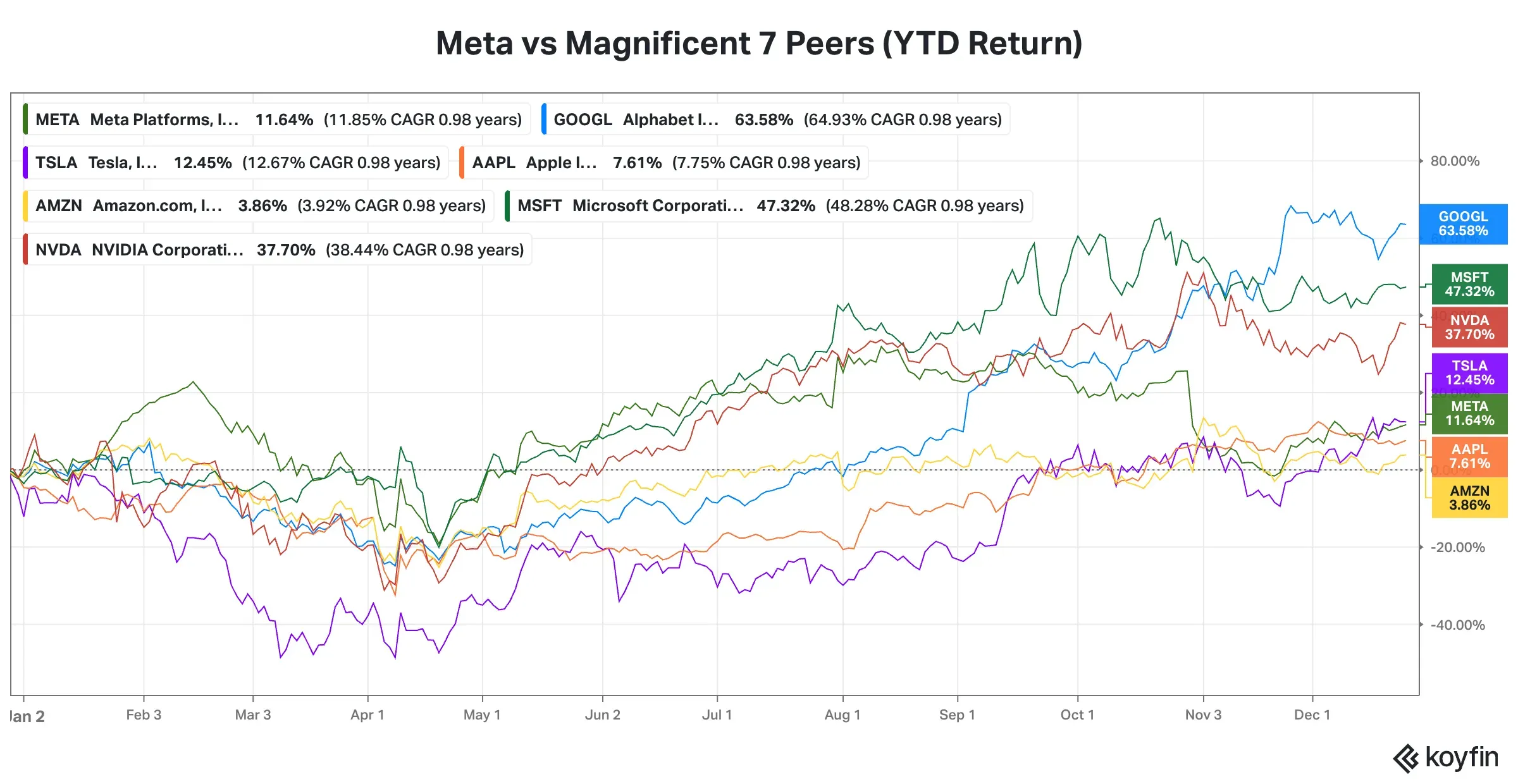

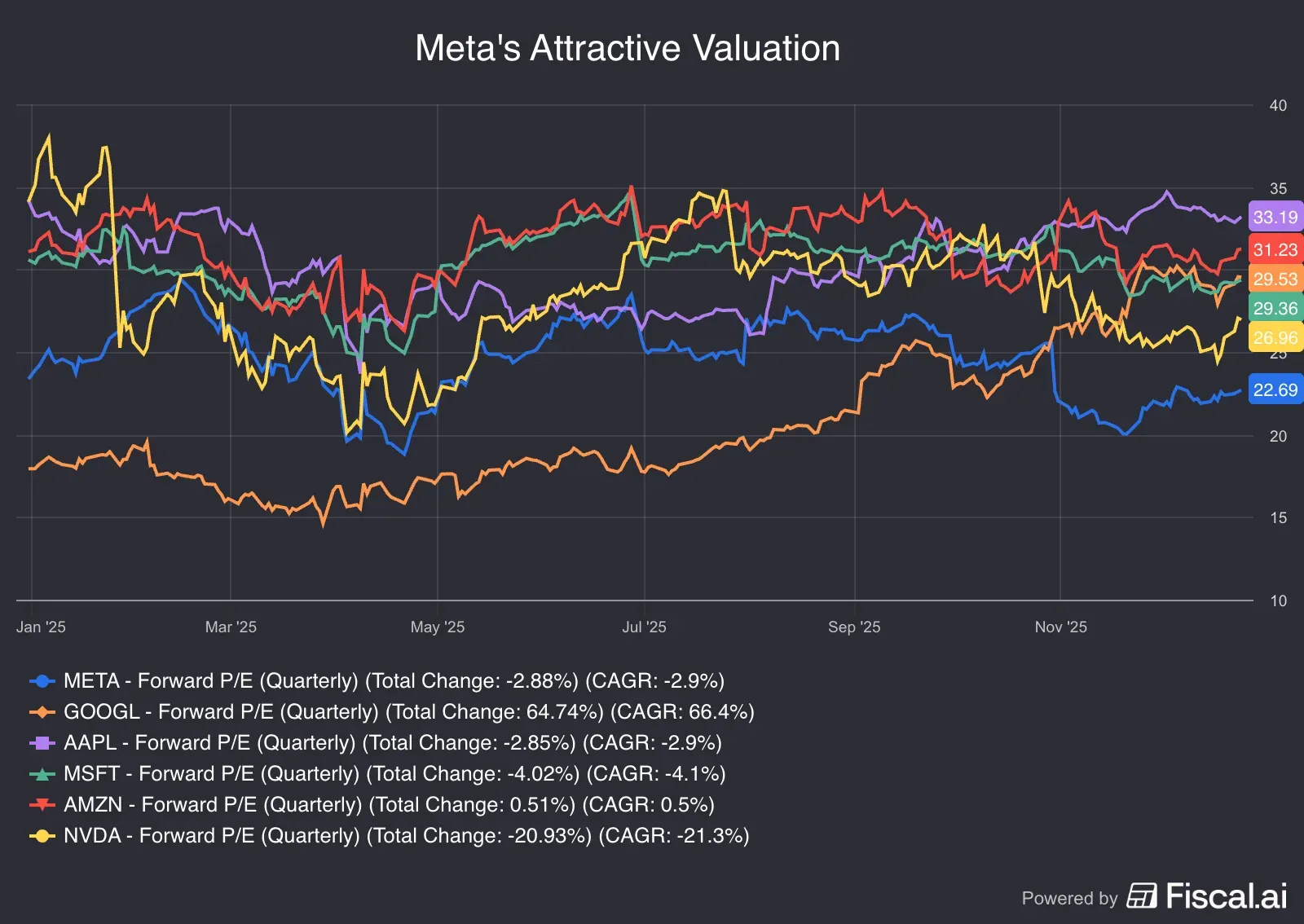

- Despite underperforming most Magnificent Seven peers, Meta trades at a relative discount.

- Wall Street is broadly bullish even as retail sentiment stays cautious.

As Meta Platforms, Inc.’s (META) challenging year draws to a close, investors also hope its struggles will finally come to an end. Despite the high-profile launch of its Super Intelligence division and aggressive poaching of elite artificial intelligence (AI) talent, Meta failed to assuage investor doubts over the payoff from its heavy AI spending. Market chatter about the company padding its financials by extending the shelf life of its data center assets exacerbated the weakness.

Even though Meta’s stock is up nearly 13% this year, it trails five of its Magnificent Seven peers—outperforming only Amazon (AMZN) and Apple (AAPL). For a stock that ranked as the second-best performer behind Nvidia in 2024 with a 64% gain, that relative showing is underwhelming.

Where Meta Erred

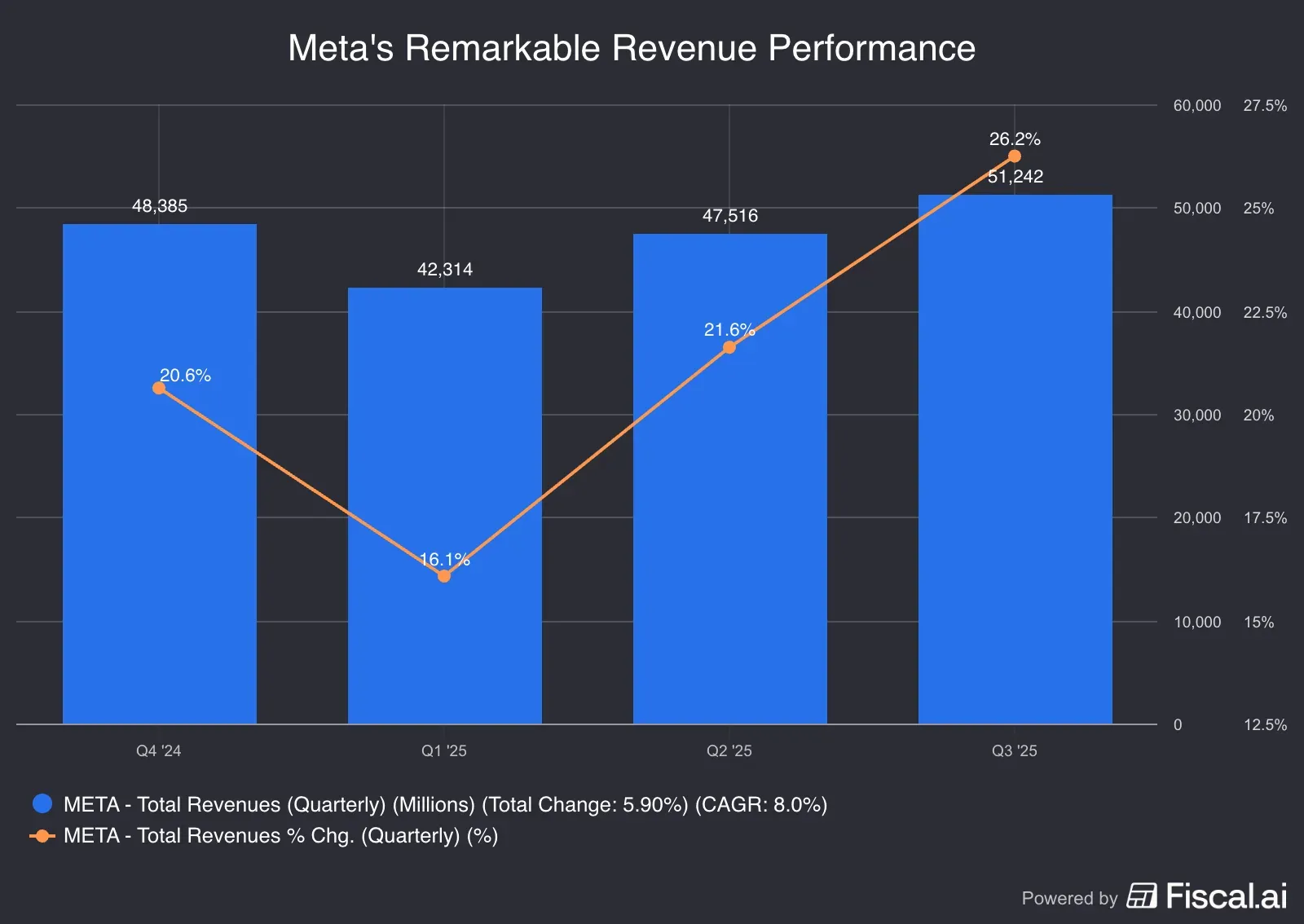

The Mark Zuckerberg-led company continued to grow revenue at a pace that invariably exceeded market expectations as the ad market recovery took a firm hold. The first quarter saw a deceleration in the year-over-year (YoY) revenue growth, but since then, the topline has grown at an accelerated rate. The third quarter’s revenue marked a record number for Meta.

Source: Fiscal.ai<

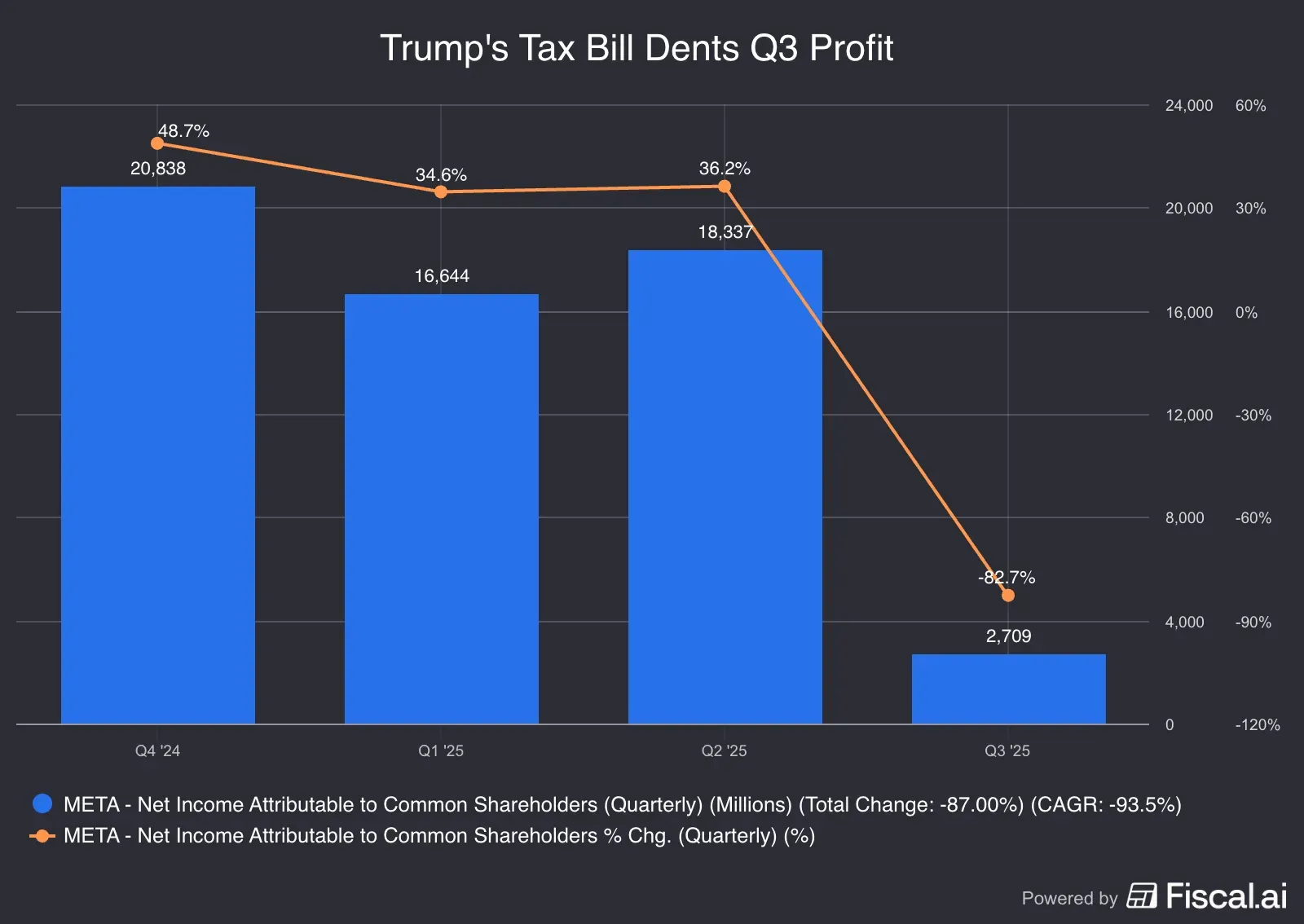

After growing at a reasonably healthy rate, the bottom line plummeted in the September quarter, dropping 82.7%, dragged by the impact of President Donald Trump’s “One Big Beautiful” tax bill—this visibly upset investors. After disclosing the quarterly results, the stock shed a whopping 11% in a single session. This is despite the company appeasing investors by stating that additional provisioning will significantly reduce its tax bill for the remainder of 2025 and the subsequent years.

Source: Fiscal.ai.<

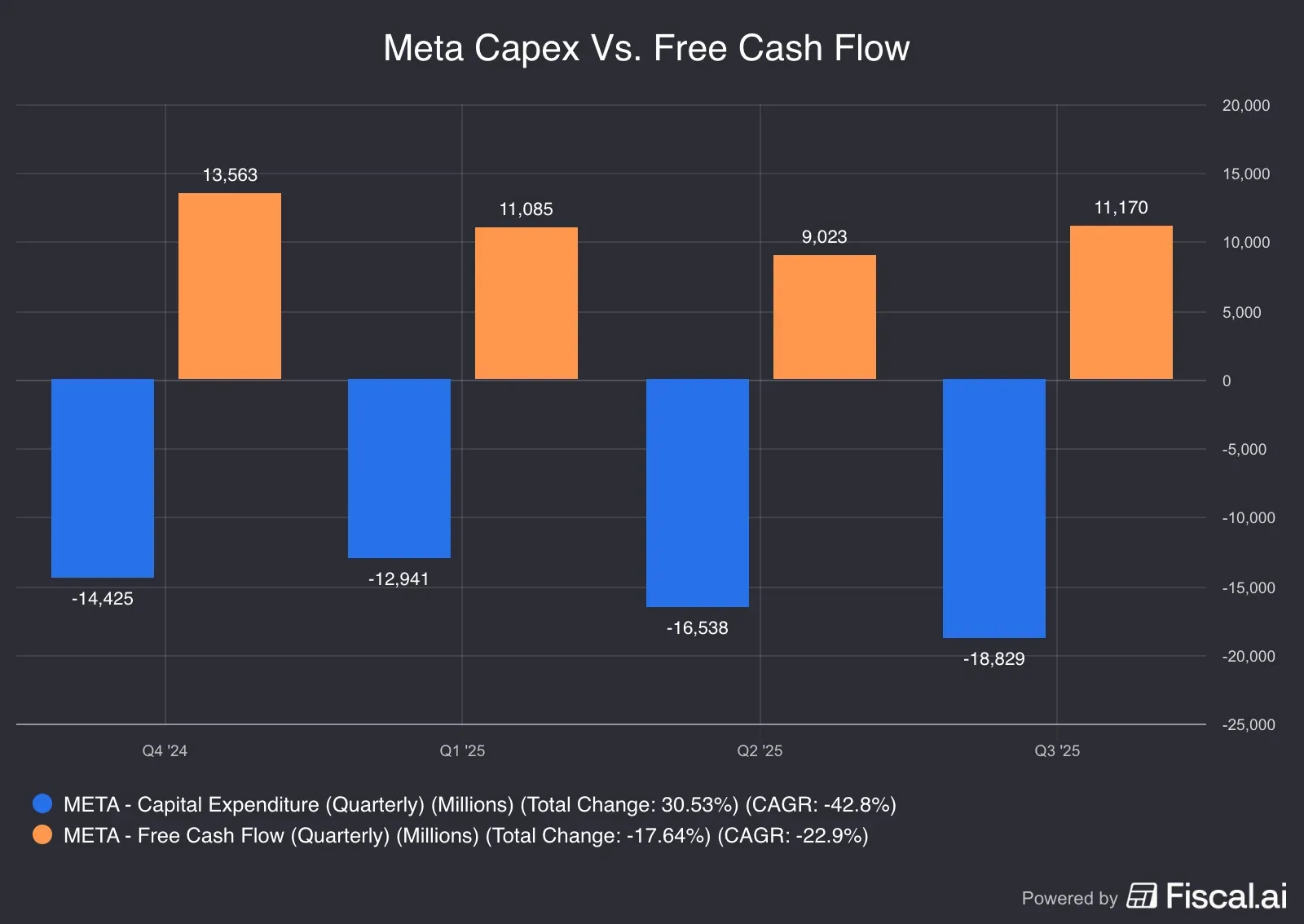

More concerning for investors is Meta’s capital spending, which is rising as it invests in data centers. For 2025, the company expects capex to surge to $70 billion to $72 billion. Zuckerberg has committed to investing at least $600 billion in the U.S. toward building data centers. According to its website, Meta operates 30 data centers, including one each in Ireland and Denmark.

Heavy investment in data centers is critical to staying competitive in the artificial intelligence race, particularly for training large language models, as Meta pursues its longer-term goal of achieving artificial general intelligence (AGI). The company’s in-house llama LLM, although initially creating a splash, has lagged behind offerings from rivals such as Alphabet.

Source: Fiscal.ai<

Meta Cheapest Among Mag 7s

The year’s lackadaisical showing has made Meta’s stock attractive within the Magnificent Seven group. Its forward price-earnings (P/E) multiple is at 22.69.

Source: Fiscal.ai<

Morgan Stanley analyst Brian Nowak, who has an ‘Overweight’ rating and $750 price target for the stock, outlined three catalysts that underpin the bullish thesis for Meta stock. Revenue revisions, a 2026 operating expenses under $155 billion, and models & monetization nodes from the Superintelligence team will drive outperformance, he said.

Nowak believes that investors are underappreciating the company’s revenue runway and innovation.

“META remains one of a handful of companies that can leverage its leading data, distribution and investments in AI to drive earnings power and tech leadership.”

Wedbush analysts also echoed a similar sentiment. In a note released earlier this month, the analysts said additional cost discipline could provide upside. Nevertheless, Meta is the firm’s top advertising pick for 2026, as it remains well positioned to benefit from resilient digital ad trends, strong adoption of Advantage+, and monetization of new channels.

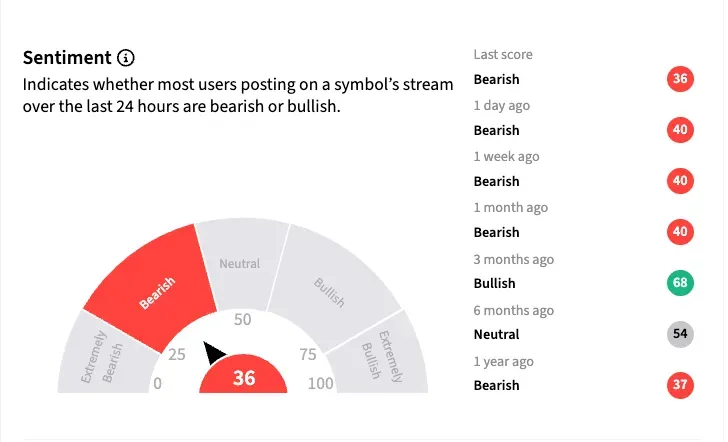

What Retail Feels About META

Despite Meta now trading at more affordable levels, retail investors are a little jittery about the stock prospects. On Stockwits, retail sentiment toward the stock was ‘bearish’ as of early Friday. The mood has remained downbeat for much of the year.

According to Koyfin, 90% of the 67 analysts covering the stock have Buy-equivalent ratings, while the remaining analysts are on the sidelines. The average analyst price target for the stock is $837.15, implying roughly 25% upside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<