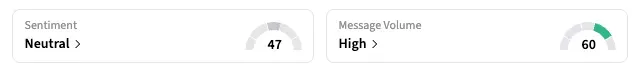

Stocktwits sentiment shifted higher to ‘neutral,’ signaling a cautious stance among retail investors after poor results from Chipotle Mexican Grill and Cava.

- The burger chain is expected to report a 3.2% rise in quarterly revenue and adjusted profit growth.

- Stocktwits sentiment shifted higher to ‘neutral,’ signaling a cautious stance among retail investors after poor results from Chipotle Mexican Grill and Cava.

- McDonald’s is scheduled to issue its quarterly report before the market opens.

McDonald’s Corp.’s shares fell 0.3% in early premarket on Wednesday, with Stocktwits sentiment in the ‘neutral’ range, just ahead of the fast-food chain’s quarterly report.

Investors are approaching the industry bellwether’s earnings with a cautious outlook. Chipotle Mexican Grill and Cava Group recently posted weak results, highlighting softness among low-income and younger consumers — key segments for McDonald’s. In contrast, Yum Brands, the parent of KFC and Taco Bell, delivered upbeat earnings.

In a recent investor note, Morgan Stanley analysts said McDonald’s could post a “modest miss” in Q3. Analysts expect McDonald’s to report a 3.2% rise in revenue to $7.09 billion, and adjusted EPS of $3.33, a cent higher than the year-ago quarter, according to Koyfin.

As of Tuesday, 17 of the 37 analysts covering the stock had a ‘Buy’ or higher rating, while 18 rated it ‘Hold,’ and two had a ‘Sell’ rating, according to Koyfin data. Their average price target of $330.10 implies a more than 10% upside over the stock’s last close.

On Stocktwits, the retail sentiment shifted to ‘neutral’ as of early Wednesday, from ‘bearish’ the previous day. Users said that restaurant earnings showed that consumers were looking for value meals, something that might have worked in favour of McDonald’s

“$CAVA $CMG $MCD $SBUX $SG the consumer has spoken: no more expensive slop,” remarked one user.

As of the last close, McDonald’s stock is up 7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<