According to a Fortune report, citing sources familiar with the matter, the sale price is in the range of $1.5 billion to $2.5 billion.

Payments Giant Mastercard (MA) and the U.S. crypto exchange Coinbase (COIN) have reportedly held advanced discussions with UK-based stablecoin firm BVNK for a potential takeover.

According to a Fortune report, citing sources familiar with the matter, terms and the winning bidder haven’t been finalized, but the sale price is in the range of $1.5 billion to $2.5 billion. The report cautioned that the talks may not result in a final deal, but at present, Coinbase appears to be at an advantage over Mastercard.

According to the report, BVNK enables companies to utilize stablecoins for customer transactions, cross-border payments, global treasuries, and other areas. In December, BVNK raised $50 million in a funding round, which valued the startup at about $750 million. Haun Ventures led the fundraising, with participation from Coinbase and Tiger Global. Earlier this week, the company also got the backing of Citigroup’s investment arm.

Mastercard investors were spooked after a landmark stablecoin legislation advanced in Congress. Digital tokens, typically linked one-to-one with the dollar, enable consumers to pay merchants directly from their cryptocurrency wallets. This method bypasses traditional banking and card networks, raising concerns about Mastercard and its peers. The stock has gained 6.7% this year, underperforming the over 15% gains of the S&P 500, while Stablecoin issuer Circle has surged nearly 400% since its listing.

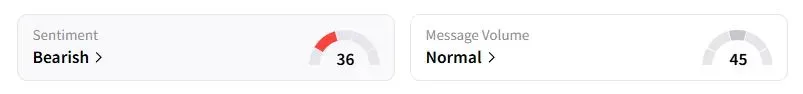

Retail sentiment on Stocktwits about Mastercard was in the ‘bearish’ territory at the time of writing.

However, analysts said, following the initial selloff, the concerns were overblown due to limited near-term risks. Mizuho said that the networks are mostly exposed to global consumer credit, which is “incredibly sticky,” and regulated U.S. debit, which is “already at barebones pricing.”

Yet, Mastercard and its rival Visa have indicated that they are willing to move fast into the industry and have inked several agreements with stablecoin firms. Mastercard said in July that it’s working to add Fiserv’s FIUSD stablecoin into a range of its payment products. Analyst projections suggest that there might be a good reason behind the tie-ups.

While less than 1% of international transactions were carried out through stablecoins, Bloomberg has projected that number could reach 25% by 2030. The forecast suggested that annual transaction volume through stablecoins could top $55 trillion in just a few years.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<