While Tech Mahindra rose ahead of earnings, Tata Motors adjusted sharply post demerger.

Indian equity markets ended lower for the second consecutive day, with the Nifty index ending below 25,150 in a volatile weekly expiry session. All sectors ended in the red, with PSU banks, metals, and consumer durables leading the weakness.

On Tuesday, the Sensex closed 297 points lower at 82,029, while the Nifty 50 ended down 81 points at 25,145. Broader markets saw a bigger selloff, with the Nifty Midcap index falling 0.8% and the Smallcap index declining 1%.

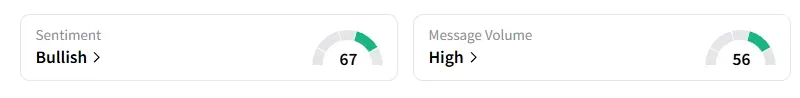

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ by market close on Stocktwits.

Stock Moves

Tech Mahindra was among the top Nifty gainers, rising over 1% ahead of its Q2 earning report due today. Other earnings movers included JustDial (-5%), Bank of Maharashtra (-3%), IREDA and Anand Rathi (+3%), and ICICI Prudential Life (+1%).

Tata Motors shares readjusted (-40%) on the first day of trading after its demerger. The CV business has been spun off into a separate listed company, so today’s price reflects only the passenger vehicles and JLR units.

IEX ended 1% lower as it faces a new plea request from the electricity tribunal regarding market coupling, impacting power exchange dynamics

RBL Bank shares ended 1% higher on reports that the UAE’s second-largest lender, Emirates NBD, is in advanced talks to acquire a 51% controlling stake. A&Y Market Research noted that the stock recently broke out of a resistance zone (₹270-₹277) after multiple touches, indicating strong buying interest. However, it’s now approaching a significant weekly resistance level near ₹300. A breakout above ₹300 could pave the way for further upside potential, but rejection at this level could spark a potential pullback. They advised waiting for a clean breakout above ₹300 before buying.

LG Electronics India saw a blockbuster debut on Tuesday with 50% listing gains. Front Wave believes that at current levels (₹1,700), valuations appear fair relative to near-term earnings, and part profit booking is prudent after the sharp post-listing rally.

Stock Calls

Mayank Singh Chandel flagged a buy call on Swiggy. After a downtrend, the stock began accumulating at lower levels and has been gradually moving up since May, indicating that buyers are returning. It is also taking support near the 50 EMA and following a rising trendline, which means strength in the short-term trend. Chandel recommended entering at the current market price with a stop loss below ₹403.

Markets: What Next?

Globally, European markets traded lower, while US stock futures indicate a weak start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com. <