March saw a notable decline in daily volumes in both cash and derivative segments of stock exchanges, thanks to a heightened volatility in the equity market.

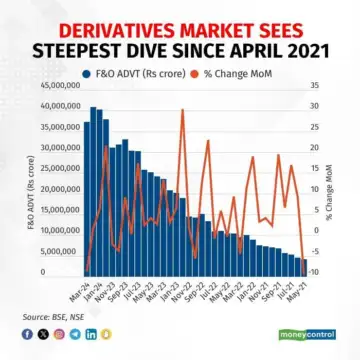

The average daily turnover in the equity cash segment of the BSE and the NSE dropped 13.33 percent, the most since October 2023, to Rs 1.12 lakh crore. Similarly, the average daily turnover for derivatives decreased by 8.76 percent to Rs 373.44 lakh crore, marking the sharpest fall since April 2021, from Rs 409.27 lakh crore in February.

“Average turnover in the cash segment in March fell compared to February due to the correction in the overall market from the second week of March and even sharper correction across the small and midcaps. The average turnover in derivatives fell as apart from the above reason, bounce in the third week of March was patchy among the F&O stocks. Also year-end considerations meant that the overall positions were reduced during the course of the month,” said Deepak Jasani, head of retail research at HDFC Securities.

Indian markets saw a downturn due to concerns over mid and small cap stock valuations raised by the Securities and Exchange Board of India, dampening investor sentiment and reducing participation in mid and small cap stocks, analysts said.

In March, the Sensex and the Nifty gained 1.6 percent each, while the BSE Smallcap and the BSE Midcap indices fell 0.6 percent and 4.55 percent.

Shrey Jain, founder and chief executive of SAS Online – India’s Deep Discount Broker, believes that the investor participation should improve going forward. The S&P500 index hitting a new lifetime high in the US will have a positive effect on Indian equities as well. Foreign portfolio investors have exhibited keen interest in Indian equities in March. If the money flows continue, then it will be supportive for stock prices, Jain added.

Last week, markets surged on a more dovish stance from the US Federal Reserve, driving global indices to record highs and boosting stocks. The Fed’s decision to maintain interest rates met market expectations unanimously, signalling no immediate need for rate hikes. Despite a robust labour market, the Fed retained its projected three rate cuts for the year, emphasising the importance of a sustainable slowdown in inflation.

Several analysts anticipate a base forming in indices after recent corrections, with quality companies hitting key support levels. They recommend accumulating quality stocks for the long term, foreseeing ongoing consolidation paving the way for the next upward movement, particularly in largecaps.

Analysts further said that in the run up to the elections, the Nifty50 index should remain in a narrow range with an upward bias. If the Nifty crosses the previous life high of 22,526, then it should touch 22,800 where it may face some resistance. Outcome of the monetary policy review by the Reserve Bank of India will be watched keenly to take cues about liquidity management and impending cuts in policy interest rates. Traders should focus on largecap stocks and maintain stop loss, they added.

Nuvama Research advises turning bullish after the recent spate of corrections in midcaps and smallcaps, seeing it as part of an ongoing bull market. They suggest taking long positions, noting oversold conditions at key support levels. With the broader market cooling down and largecaps experiencing corrective phases without any major impact on Nifty50, they anticipate a favourable risk premium for long positions, buoyed by strong global market trends, upcoming earnings seasons, and impending general elections.