The apex cryptocurrency fell 0.5% to $115,905, while Ethereum was down 2.9% to $4,529.43, and XRP fell 2% to $3.00, according to CoinGecko data.

Bitcoin, Ethereum, and XRP edged lower in early trading on Tuesday, ahead of the Federal Reserve’s much-awaited meeting of policymakers, where the U.S. central bank is widely expected to lower its benchmark interest rates.

The apex cryptocurrency fell 0.5% to $115,905, while Ethereum was down 2.9% to $4,529.43, and XRP fell 2% to $3.00, according to CoinGecko data. Among other major tokens, Solana was down 2.7% and Cardano fell 3.7%, as retail traders exercised caution.

However, both Bitcoin and Ethereum ETFs logged strong inflows on Monday, indicating institutional demand remains strong as Bitcoin prices stay below the $117,000 mark. According to SoSoValue data, spot Bitcoin ETFs logged inflows of $260 million, while spot Ethereum ETFs saw inflows of $359.7 million.

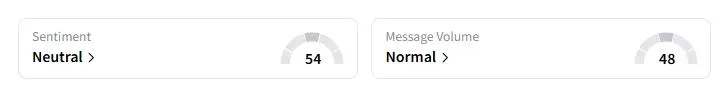

Retail sentiment on Stocktwits about the iShares Bitcoin ETF was in the ‘neutral’ territory at the time of writing.

Analysts and investors largely expect the Federal Open Market Committee to deliver a 25-basis-point rate cut on Wednesday, after weak jobs data raised concerns about the U.S. economy.

Fundstrat co-founder and BitMine chairman Tom Lee said on CNBC on Monday that the U.S. central bank can reinject confidence by saying “we’re back into an easing cycle.” He also noted the jumps in equity markets in 1998 and 2024, when the Fed lowered rates after a long pause, and added that a rate cut would be a “real improvement in liquidity.”

He also noted that Bitcoin and Ethereum are poised for a “monster run” in the last three months of the year, if the Fed decides to cut.

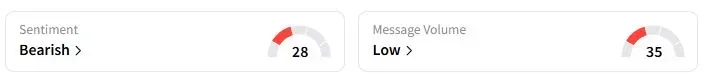

According to Stocktwits data, traders were still ‘bearish’ about Ethereum at the time of writing.

Digital assets analyst Ted Pillows said that Ethereum has strong support around $3,800-$4,000.

“This is the level I’m eyeing to load heavily on Ethereum. If that happens, we will get a lot of quality alts on good discounts too,” Pillows said.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<