LivePerson saw retail chatter skyrocket 8,000% in 24 hours after expanding its partnership with Google Cloud.

The tech-heavy Nasdaq Composite Index closed 1.21% higher at 21,169 on Wednesday, as Apple’s $100 billion U.S. manufacturing investment lifted investor sentiment. LivePerson, Fortinet, and Smith Micro Software saw the highest retail chatter on Stocktwits among tech companies in the last 24 hours. Here’s a detailed analysis of how retail responded to the three stocks in the news:

1. LivePerson Inc. (LPSN): The technology company saw retail chatter skyrocket 8,000% in 24 hours after the company expanded its partnership with Google Cloud on Wednesday, integrating the tech giant’s advanced artificial intelligence tools into its Connected Experience Platform.

Retail sentiment around the stock improved to ‘extremely bullish’ (80/100) from ‘bearish’ territory the previous day. Message volume jumped to ‘extremely high’ (95/100) from ‘low’ levels in the last 24 hours.

LivePerson stock traded over 8% lower in premarket on Thursday.

2. Fortinet Inc. (FTNT): The cybersecurity provider saw retail chatter surge 4,500% in 24 hours after the company reported second-quarter (Q2) earnings on Wednesday.

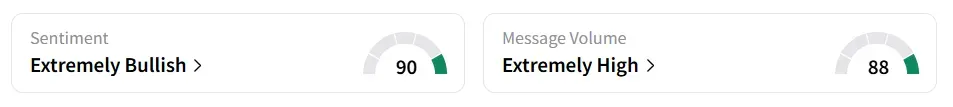

Retail sentiment around the stock improved to ‘ extremely bullish’ (90/100) from ‘bearish’ territory the previous day. Message volume jumped to ‘extremely high’ (88/100) from ‘normal’ levels in the last 24 hours.

The company’s Q2 revenue and adjusted earnings per share (EPS) of $1.63 billion and $0.64 both beat the analysts’ consensus estimate of $1.62 billion and $0.59, respectively, as per Fiscal AI data.

Fortinet stock traded over 21% lower in Thursday’s premarket.

3. Smith Micro Software Inc. (SMSI): The software services provider’s retail message count increased by 3,000% in 24 hours after Q2 earnings on Wednesday.

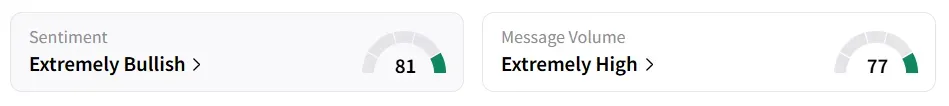

Retail sentiment around the stock improved to ‘extremely bullish’ (81/100) from ‘neutral’ territory the previous day. Message volume jumped to ‘extremely high’ (77/100) from ‘low’ levels in the last 24 hours.

The company’s Q2 revenue of $4.420 million missed the analysts’ consensus estimate of $4.68 million, as per Fiscal AI data. However, adjusted loss per share of $0.14 surpassed the consensus estimate of a loss per share of $0.25.

Smith Micro Software stock traded over 5% higher in Thursday’s premarket.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<