Many countries maintain gold reserves for a variety of reasons. But, before we get into it, do you understand what gold reserves are? Gold reserves refer to the quantity of gold held by a central bank or government as a financial asset.

These reserves can serve as a form of currency stabilisation and can provide security during times of economic uncertainty. This system tied the value of a country’s currency to a fixed amount of gold, requiring nations to keep large gold reserves to support their money supply.

The United States, for instance, started amassing significant gold reserves in the late 19th century. With the Gold Reserve Act of 1934, gold ownership was transferred from private persons to the US Treasury, significantly increasing the nation’s reserves. According to the World Gold Council, the United States of America has the largest gold reserves, nearly equalling the combined holdings of France, Italy, and Germany.

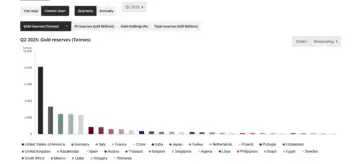

List of Countries with Highest Gold Reserves

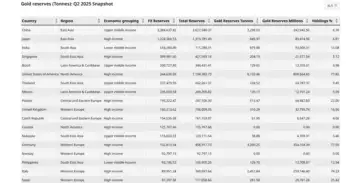

Here’s the list of the top 10 countries with the most gold reserves in the world. The data has been compiled from the latest reports by the World Gold Council. These countries hold a significant amount of gold as part of their national reserves, which can impact global financial markets.

| Country | Region | Gold Reserves Tonnes | Gold Reserves Millions | Holdings % |

| United States of America | North America | 8133.46 | 859,665 | 77.85 |

| Germany | Western Europe | 3350.25 | 354,104 | 77.50 |

| Italy | Western Europe | 2451.84 | 259,146 | 74.23 |

| France | Western Europe | 2437.00 | 257,578 | 74.96 |

| China | East Asia | 2298.53 | 242,943 | 6.70 |

| India | South Asia | 879.98 | 93,009.3 | 13.08 |

| Japan | East Asia | 845.97 | 89,415 | 6.81 |

| Turkey | Central and Eastern Europe | 634.76 | 67,090.3 | 50.11 |

| Poland | Central and Eastern Europe | 515.47 | 54,482.8 | 22.00 |

| United Kingdom | Western Europe | 310.29 | 32,795.7 | 16.56 |

| Spain | Western Europe | 281.58 | 29,761.3 | 25.42 |

| Thailand | SoutheastAsia | 234.52 | 24,787.4 | 9.45 |

| Singapore | SoutheastAsia | 204.15 | 21,577.5 | 5.12 |

| Algeria | Middle East & North Africa | 173.56 | 18,344 | 23.00 |

| Libya | Middle East & North Africa | 146.65 | 15,500.3 | 15.54 |

Source: World Gold Council

1. United States

The United States holds the world’s largest gold reserves at 8,133 tonnes. This massive accumulation is mainly due to its historical role in the global monetary system. Specifically, the Bretton Woods Agreement of 1944 fixed the dollar to gold, making it the central currency. Most of the world’s gold flowed into the U.S. as a result of trade surpluses and to back the dollar’s value-the gold acts as a foundation of trust in the nation’s financial stability.

2. Germany

Germany holds the second-largest gold reserves, totalling 3,350 tonnes. The country rapidly built up these reserves after World War II during its “economic miracle”. This accumulation was a deliberate effort to establish the Deutsche Mark’s credibility. It helped create confidence in the German economy as a strong, stable global power. The gold remains a key part of Germany’s reserve assets for security and diversification.

3. Italy

Italy holds the third-largest gold reserves, totalling 2,452 tonnes. Similar to other Western European nations, a significant portion of Italy’s gold was accumulated during the post-WWII era. This period saw a fixed exchange rate system that required nations to hold gold to maintain the value of their currencies. The large gold holding is considered a national asset, providing a crucial buffer against financial crises and instability.

4. France

France holds the fourth-largest gold reserves, amounting to 2,437 tonnes. Much of this gold was amassed in the decades following World War II, during the Bretton Woods system. A strong emphasis was placed on holding gold rather than U.S. dollars as part of a national policy. These reserves provide confidence in France’s financial position and are a significant component of its central bank’s balance sheet.

5. China

China maintains official gold reserves of 2,299 tonnes. However, analysts believe China’s actual holdings might be higher due to state secrecy. China is the world’s largest gold producer and a major buyer. It is actively accumulating gold as part of a long-term plan to diversify its massive foreign-exchange reserves. This move is strategic, aiming to reduce dependence on the U.S. dollar and enhance the Yuan’s international standing.

6. India

India’s central bank holds gold reserves totalling 880 tonnes. The Reserve Bank of India has been consistently adding to its gold stock. Gold is widely valued in Indian culture and economy. The central bank uses gold to diversify its reserves. This serves as a crucial safety net during economic crises or periods of stress in global markets.

7. Japan

Japan holds gold reserves of 846 tonnes. As the world’s third-largest economy, its reserves are substantial but primarily built up to stabilise its currency and economy. Japan uses gold as a traditional safe-haven asset to diversify its foreign exchange holdings. The gold provides a layer of security against global financial volatility and uncertainty.

Conclusion

Gold reserves act as the foundation of a country’s financial stability, providing a tangible asset that can be used to back up its currency. In times of economic uncertainty, gold reserves can help bolster confidence in the country’s monetary system and maintain its value.

As of the World Gold Council Report 2025 [Q2], the United States stands as the country with the largest gold reserves in the world, holding approximately 8,133.5 tonnes of gold. Following the U.S., Germany, Italy, and France are among the top countries with significant gold reserves, further solidifying their economic standing on a global scale.

Central banks hold approximately 20% of all mined gold, reflecting its significance in maintaining financial security and liquidity. They typically consist of gold bullion and coins that are officially owned by the state. This includes both physical gold and unallocated gold accounts held with foreign entities.

Throughout history, gold reserves have been viewed as critical national assets, often influencing economic policies and wartime strategies. Therefore, this article not only highlights the countries with substantial gold holdings but also underscores the importance of gold as a strategic asset in global finance.