Clear Street cut its price target to $7 from $93, saying KRRO-110 failed to reach protective protein levels in its Phase 1/2 study for Alpha-1 Antitrypsin Deficiency.

- Clear Street cut its price target to $7 from $93, saying KRRO-110 failed to reach protective protein levels in its Phase 1/2 study for Alpha-1 Antitrypsin Deficiency.

- Korro said differences between healthy volunteers and patients guided its pivot to a GalNAc delivery approach, with a new AATD candidate expected in early 2026.

- Retail traders on StockTwits pointed to the company’s cash position and second pipeline program.

Korro Bio shares crashed over 75% after-hours on Wednesday after analysts downgraded the stock and the company said it would cut about 34% of its workforce following disappointing results from its lead drug for Alpha-1 Antitrypsin Deficiency (AATD), a rare genetic condition in which the liver does not make enough of a protein needed to protect the lungs.

Analyst Downgrades

Clear Street downgraded Korro Bio to ‘Hold’ from ‘Buy’ and cut its price target to $7 from $93. The analyst said KRRO-110 failed to achieve protective levels of the corrected protein in its Phase 1/2 trial for Alpha-1 Antitrypsin Deficiency, leading to the discontinuation of development. The analyst also said that with the step back in timeline and the move away from its lipid nanoparticles (LNP) delivery approach, Korro’s positioning in the disorder is “compromised.”

Cantor Fitzgerald also downgraded the stock, moving its rating to ‘Neutral’ from ‘Overweight’.

Lead Drug Falls Short In Early Trial

Korro said KRRO-110 did produce functional protein in patients with Alpha-1 Antitrypsin Deficiency, but did not reach the levels it predicted from earlier preclinical work. The company said differences between healthy volunteers and AATD patients contributed to its pivot toward a new delivery approach called GalNAc. A new AATD development candidate using this approach is expected in the first half of 2026.

Pipeline Pivot

Korro also nominated KRRO-121, a GalNAc-conjugated RNA-editing therapy designed for patients with hyperammonemia. The company plans to move the program into clinical testing in the second half of 2026.

Workforce Reduction

Korro said it will reduce its workforce by nearly 34%, with the cuts affecting all levels of the organization. The company said the restructuring is expected to extend its cash runway into the second half of 2027, giving it sufficient capital to deliver clinical data from KRRO-121, advance at least one additional program, and conduct partnership discussions to broaden pipeline development.

Korro also said it expects to incur about $2.4 million in one-time restructuring charges, including employee severance, benefits, and related termination costs, most of which it expects to recognize during the fourth quarter of 2025.

Executive Exit

Korro said Chief Medical Officer Kemi Olugemo resigned, effective Wednesday. The company ended the third quarter with $102.5 million in cash, cash equivalents, and marketable securities. Collaboration revenue for the period was $1.1 million, and net loss totaled $18.1 million.

Stocktwits Users Flag Cash Position

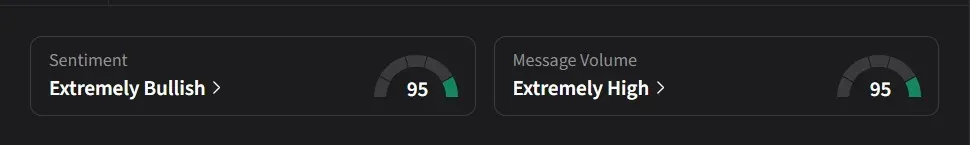

On Stocktwits, retail sentiment for Korro was ‘extremely bullish’ amid ‘extremely high’ message volume, placing it among the top five trending equities on the platform.

One user suggested the stock could recover toward $10 in the morning, noting the company has ample cash and another program in development that could resonate with investors.

Another user said the pullback was a buying opportunity, arguing that the company has significant cash on hand and a second product in the pipeline.

Korro’s stock has declined 17% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<