Based on its outstanding shares, the offer price values the company at $15.1 billion.

Buy-now, pay-later firm Klarna Group (KLAR) drew retail buzz in the early hours of Wednesday after the company priced its initial public offering at $40 per share, raising $1.37 billion.

According to a Bloomberg News report, Sequoia Capital, the company’s top shareholder, has seen a gain of $2.7 billion on its original investment of $500 million in the company in 2010.

However, the company’s valuation is much lower than the $45.6 billion it attained in 2021 following a fundraise from Softbank, following a slump in investor interest amid an elevated interest rate environment. The stock is set to begin trading in New York on Wednesday.

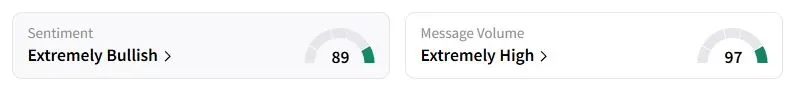

Retail sentiment on Stocktwits about Klarna was in the ‘extremely bullish’ territory at the time of writing, while retail chatter was ‘extremely high.’ The ticker has already garnered over 1,500 watchers on Stocktwits.

The company, founded in 2015, reported in an earlier filing that its revenue for the first six months of 2025 was $1.52 billion, while it incurred a net loss of $153 million during this period.

In the same period a year ago, Klarna generated $1.33 billion in revenue, while incurring a net loss of $38 million. It has 111 million active users and 790,000 merchants on its platform for its BNPL and other services.

The firm is currently expanding its “fair financing” program that extends larger-ticket loans to customers over a longer period, in a bid to become a full-fledged bank. Rival Affirm stock has rallied over 40% this year.

“This is wildly oversubscribed, I’m seeing more hype for this IPO than Figma,” one user noted.

Figma stock had jumped an astonishing 250% on debut in August. Another BNPL firm, Chime, rose nearly 60% on debut earlier this year.

After a tepid start to the year, the IPO market is abuzz after the easing of trade tensions and the prospects of three 25-basis-point rate cuts by the Federal Reserve.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<