A rescue financing and loan settlement halted an impending asset seizure after Oxford’s default.

- A rescue financing and loan settlement halted an impending asset seizure after Oxford’s default.

- A two-stage preferred stock deal supplies up to $6 million to stabilize operations and restructure debts.

- New turnaround-focused leadership was appointed as part of the recovery plan.

Kala Bio surged 22% after hours on Tuesday after the company disclosed a rescue financing agreement that temporarily stabilizes its operations and averts a pending asset seizure by its lender. The move marks the company’s reversal since September, when its eye disease therapy KPI-012 failed a Phase 2 trial, triggering a roughly 90% collapse in the stock and a wave of analyst downgrades.

Emergency Financing Steps In After Default

The after-hours rally followed Kala’s filing detailing a sequence of events that began on Sept. 29, when Oxford Finance issued a notice of default under the company’s loan agreement and declared all obligations immediately due.

On Oct. 19, Oxford informed Kala it intended to foreclose on all remaining assets, sweep all of the company’s cash, and restrict the use of funds to minimal payroll expenses necessary to execute the foreclosure. The same day, Kala terminated all remaining employees except those required to support Oxford’s process.

Oxford later paused the foreclosure on Nov. 3 and allowed Kala to access $125,000 of previously swept cash to negotiate a potential transaction. On Nov.9, Kala executed a convertible loan agreement with investor David Lazar for $375,000 to fund the preparation of its quarterly filing and support negotiations for further investment.

Lifeline Private Placement Up To $6 Million

The company then entered into a securities purchase agreement on Nov. 23 under which Lazar agreed to provide up to $6 million in a two-stage private placement of Series AA and Series AAA preferred stock. The first closing occurred on Monday, delivering $1.8 million to Kala. The second closing, for an additional $4.2 million, requires shareholder approval to increase authorized common shares and permit conversion of the preferred stock. Kala will hold the shareholder meeting before March 31, 2026. The proceeds will fund current operations, liabilities, and expenses, with $1 million of the second closing earmarked for Oxford as part of the settlement arrangement.

Settlement Restructures Obligations

As part of the rescue package, Kala and unit Combangio entered into a loan settlement agreement with Oxford on Nov. 23. Oxford agreed to settle all outstanding payment obligations in exchange for a $2 million cash settlement and 1.62 million shares of common stock.

Once Kala pays the initial $1 million and issues the settlement shares, Oxford will release control of Kala’s bank accounts, reduce the outstanding loan balance by $7 million, and waive associated interest and final payments. The company also agreed to pay Oxford 10% of future equity financing proceeds, up to $1 million, with each such payment reducing loan obligations by 3x the amount contributed.

Oxford’s foreclosure efforts will formally end once the full settlement payment is completed. Kala is committed to pursuing a “material strategic alternative transaction” within one year to clear the remaining settlement balance.

Leadership Changes Accompany Restructuring

As part of the financing deal, David Lazar was appointed CEO and elected to the board on Nov. 21. Lazar brings a turnaround-focused background to the role. He currently leads Custodian Ventures LLC and Activist Investing LLC, firms that specialize in turnaround situations involving distressed public companies.

Todd Bazemore, the prior CEO, stepped down from the role but remains on the board. Meanwhile, chief financial officer Mary Reumuth was terminated effective immediately following the first closing, and the company also announced settlement agreements for certain former executives tied to their contractual severence rights.

Fallout From Eye Drug Trial Failure

The crisis began in late September when KPI-012, a treatment for persistent corneal epithelial defect, failed to meet all primary and secondary endpoints in the Phase 2b CHASE trial. The miss contradicted the positive signals seen in the earlier Phase 1b trial and led management to terminate development of KPI-012 and its broader mesenchymal stem cell secretome platform. Analysts at Mizuho, H.C. Wainwright and LifeSci Capital downgraded the stock immediately afterward, citing the unexpected data and lack of disclosed details.

Stocktwits Users Cite David Lazar Upside For Kala Bio

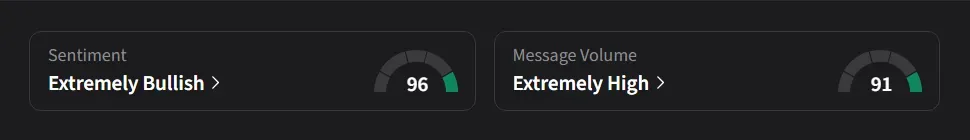

On Stocktwits, retail sentiment for Kala Bio was ‘extremely bullish’ amid ‘extremely high’ message volume.

One bullish user said, “$KALA 1.50 next leg. David Lazar play. new $CETY.”

Another user said, “Look what david Lazzar did to $opgen and find out why he make $KALA investors very rich if they are patient.”

Kala Bio’s stock has declined 91% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<