The local search platform reported a 22.5% decline in net profit, despite modest revenue growth.

Shares of Just Dial fell more than 5% on Tuesday to ₹816, on the back of weak second-quarter results.

JustDial stock reversed three straight sessions of gains and saw its biggest intra-day percentage drop since March.

Q2 Results Disappoint

The company reported a 22.5% decline in net profit to ₹119.44 crore, even as revenue rose 6.4% to ₹303.07 crore. Profit before tax also slipped 19% to ₹147.01 crore, with pressure on margins despite revenue growth. Operating performance remained steady, with EBITDA rising 6.1% to ₹87.1 crore, though the EBITDA margin edged down slightly to 28.7% from 28.8% a year earlier.

In terms of platform engagement, the firm recorded 197.7 million unique visitors during the quarter, nearly flat year-on-year but up 2.3% sequentially.

Analyst’s Take

Just Dial’s stock is holding the crucial ₹800 – ₹820 support zone even after a 22.5% drop in Q2 profit, noted SEBI-registered analyst Varunkumar Patel.

Technically, the stock is consolidating near ₹820, with a breakout above ₹880 likely to trigger the next leg higher toward ₹920 – ₹950.

However, on the downside, ₹800 is the key level to defend, and a breach could lead to a decline to ₹760 – ₹780, Patel said.

Momentum indicators remain neutral, suggesting a wait-and-watch phase until direction is confirmed through price and volume action, he added.The short-term bias hinges on the ₹800 – ₹880 band, while long-term investors may treat dips as selective accumulation opportunities.

Stock Watch

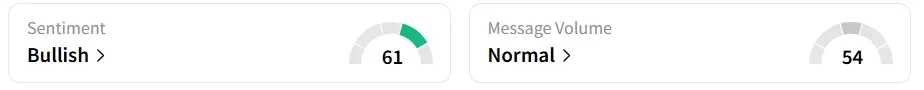

Despite the decline in stock price, retail sentiment on Stocktwits has remained ‘bullish’. It was ‘neutral’ last week.

Year-to-date, the stock has shed over 18% in value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<