In Q4, the Africa-focused e-commerce platform reported a revenue of $61.4 million, a 34% year-on-year jump, below the analysts’ consensus estimate of $64.18 million, according to Fiscal AI data.

- The company said its gross merchandise value surged to $279.5 million in Q4, expanding 36% year-on-year.

- Jumia narrowed its operating loss to $10.6 million, from a loss of $17.3 million last year.

- The company expects gross merchandise value to increase by 27% to 32% in 2026.

Jumia Technologies (JMIA) has drawn significant interest from retail traders, with chatter on Stocktwits jumping 500% over 24 hours as of Tuesday morning, after the Africa-focused e-commerce platform reported its fourth-quarter (Q4) earnings.

In Q4, the Africa-focused e-commerce platform reported a revenue of $61.4 million, a 34% year-on-year (YoY) jump, below the analysts’ consensus estimate of $64.18 million, according to Fiscal AI data.

Following the earnings, Jumia Technologies’ stock traded over 15% lower by Tuesday mid-morning.

What Are Stocktwits Users Saying?

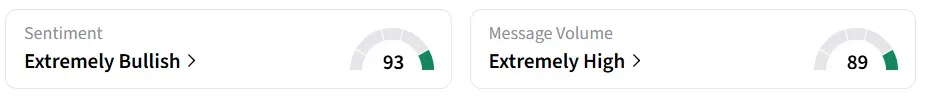

However, contrary to the stock movement, on Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. At the same time, message volume changed to ‘extremely high’ from ‘high’ levels in 24 hours.

A bullish Stocktwits user said, ‘a quarter to profitability has never been closer than right now!!’

Another user said they have bought the dip.

Growth Momentum And Outlook

The company said its gross merchandise value (GMV) surged to $279.5 million in Q4, expanding 36% YoY. Excluding operations in South Africa and Tunisia, physical goods GMV rose even more, driven by strong consumer demand.

Jumia narrowed its operating loss to $10.6 million, from a loss of $17.3 million last year, while the adjusted earnings before interest, taxes, depreciation, and amortization

(EBITDA) loss also shrank to $7.3 million from $13.7 million a year ago.

Based on how the business is performing now, the company expects GMV to increase by 27% to 32% in 2026. Adjusted EBITDA is expected to show a loss of between $25 million and $30 million. The company also reaffirmed its plan to reach break-even on an adjusted EBITDA basis and generate positive cash flow by Q4 of 2026, with full-year profitability and positive cash flow targeted for 2027.

JMIA stock has gained over 152% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<