Jefferies’ bullish call comes in the wake of DoorDash’s roughly 20% slide over the past month.

- Jefferies raised the price target on DoorDash to $260, up from $220.

- Analyst John Colantuoni stated that DoorDash has some breathing room in its 2026 projections.

- DoorDash’s third-quarter revenue and earnings per share came above Street estimates.

DoorDash Inc. (DASH) on Wednesday received a significant boost after Jefferies analyst John Colantuoni upgraded the stock to ‘Buy’ from ‘Hold’ and raised the price target to $260, up from $220.

This shift reflects mounting confidence in the company’s long-term growth trajectory, especially amid recent volatility.

Upside Amid Pullback

Jefferies’ bullish call comes in the wake of DoorDash’s roughly 20% slide over the past month. The new price target represents a 23% upside from the stock’s Tuesday closing price.

Colantuoni stated that DoorDash has some breathing room in its 2026 projections, citing planned investments that could help the company beat expectations, according to TheFly.

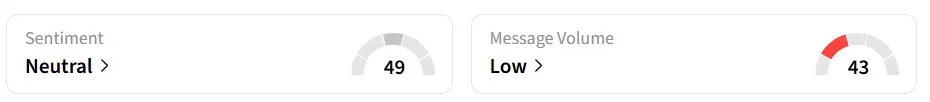

DoorDash’s stock traded over 2% higher in Wednesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘low’ message volume levels.

Advertising Is Key

According to a CNBC report, a core ingredient in Jefferies’ thesis is the rise of higher-margin advertising revenue. Colantuoni estimates that growth in ad sales could offset about $200 million of DoorDash’s incremental spending next year.

He also anticipates operational efficiencies and fixed-cost leverage in its U.S. restaurant business. The analyst highlighted that DoorDash’s core delivery business is expanding, especially among older users.

“Despite capturing ~65% share of U.S. delivery apps, DASH is only used by ~15% of adults and is responsible for less than ~6% of meals among active users,” added Colantuoni.

DoorDash’s third-quarter revenue of $3.4 billion and earnings per share (EPS) of $1.65 both surpassed the analysts’ consensus estimate of $3.35 billion and $1.25, respectively, according to Fiscal AI data.

DASH stock has gained over 26% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<