Share weakness follows weak quarterly results and buyout talks falling through.

- iRobot’s shares declined nearly 10% to a fresh low on Monday.

- Share weakness follows weak quarterly results and buyout talks falling through.

- iRobot could be on the brink of bankruptcy, having issued a going-concern warning earlier this year.

iRobot Corp.’s shares plunged by nearly 10% to a fresh low on Monday, reigniting concerns that the Roomba maker is potentially heading for bankruptcy.

Dire State

The company said last month that advanced talks with a potential buyer had fallen through, and earlier this month reported bleak numbers, exacerbating an already bleak outlook.

The company, which faces increased competition from Chinese manufacturers, has been struggling since its 2022 buyout deal with Amazon fell due to regulatory pushback. In the aftermath, it laid off 30% of its workforce, lost its founder and CEO, Colin Angle, and was left with substantial debt. In March of this year, the company issued a going concern warning.

Last week, iRobot reported a sharp decline in its third-quarter sales, which it said was “well below our internal expectations due to continuing market headwinds, ongoing production delays, and unforeseen shipping disruptions.” The company’s cash balance dropped to $25 million, even as it aggressively seeks new sources of capital.

Retail’s View

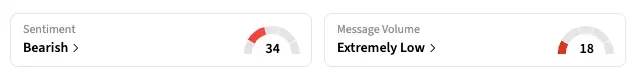

IRBT stock has fallen for five consecutive sessions, and is down 77.3% year-to-date. On Stocktwits, the retail sentiment for the ticker was ‘bearish’ as of late Monday, unchanged over the past seven days, with several users commenting about the stock weakness.

“All time lows,” remarked one user, while another stated that “if this declared bankruptcy, it could send the share price flying due to shorts covering!”

Most analysts have pulled their coverage of the company, and the two that still cover it advise holding the stock.

As of the last closing price, iRobot’s market capitalization is down to $53 million, a fraction of the $1.7 billion Amazon offered for the company back in 2022.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<