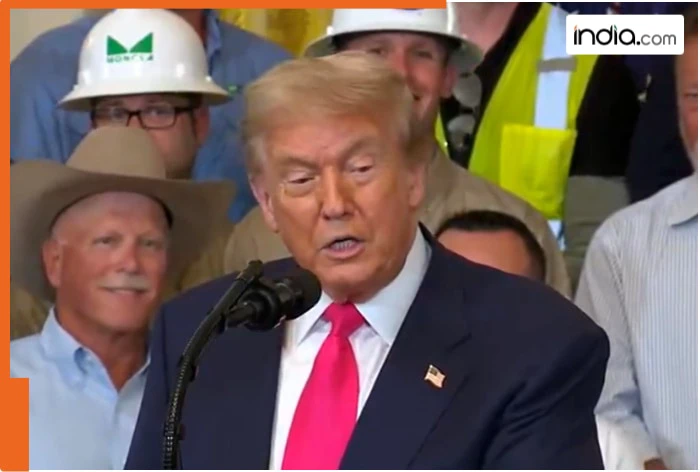

US President Donald Trump’s ambitious One Big, Beautiful Bill was passed by the lower house of Parliament after the Senate. This 840-page bill, which cuts taxes and expenses, got 218 votes in favour and 214 votes against.

But in such a situation, it becomes important to know what is there in this bill that even Elon Musk opposed it and incurred enmity with Trump. Two MPs of Trump’s own Republican Party voted against it? How will this bill affect the rich and the poor?

The most important thing about this bill is that through this, the tax cut implemented in Trump’s first term will be made permanent. It has a provision to abolish tax on tips and overtime pay. Tax relief for business, there is no tax exemption on social security in this. Electric vehicle and solar tax credits will be completely abolished.

Huge cuts in tax exemptions and social security schemes

One of the most prominent features of this bill is the $350 billion border and national security plan. This includes $46 billion for expanding the wall on the US-Mexico border, $45 billion for arranging 100,000 migrant detention beds, and a massive recruitment drive for immigration enforcement.

What will change with One Big, Beautiful Bill?

- Trump’s highly ambitious bill talks of a tax cut of $4.5 trillion. Senior citizens earning less than $75,000 annually will get an additional tax rebate of $6,000.

- Social security programs in America have been cut drastically. This bill also has a provision to cut medical aid and food assistant programs for the poor. The poor will have to work at least 80 hours a month to get medical aid. Parents of children above 14 years of age will also have to work. It is estimated that after this bill comes into force, more than 1.18 crore Americans will become uninsured by 2034. This means that they will lose their life insurance plans.

- This bill has a provision for a new savings program for children. The government will deposit one thousand dollars for children born between 2024-28. The limit of child tax credit has been increased from two thousand dollars to 2,200 dollars. Single parents earning up to 2 lakh dollars annually and parents earning up to 4 lakh dollars will get this exemption.

- The bill has a provision of $350 billion for border and national security. A wall will be built on the US-Mexico border at a cost of approximately $45 billion to stop illegal immigration. Along with this, a detention center with one lakh beds will be built here at a cost of $45 billion, where more than ten thousand immigration officers will be recruited.

- Along with this, the government has also cited the expulsion of more than one lakh illegal immigrants from the country every year.

- America will build its new air defense system on the lines of Israel. It has been named Golden Dome. A proposal of $25 billion has been made in the bill for this. It is estimated that the cost of this entire project can reach up to $500 billion. Apart from this, a proposal has also been made in this bill to spend $21 billion for ammunition and $34 billion for the naval fleet.

- The bill provides for tax deduction on interest on loans taken on vehicles manufactured in the US. This will benefit those buying new cars. But electric vehicles have been excluded from this.